Investment Banking is one of the fascinating fields in the world of finance. Interestingly, the first thing about investment banks is that they’re not banks – not even by the most creative reckoning! They neither collect money in their accounts nor loan money. They’re specially organized, equipped and licensed financial services, and advisory organizations mandated to primarily help institutional, organizational, corporate or government clients raise money (for projects, etc.,) through primary and secondary equity and debt, bond, and derivatives markets. Due to their fast-paced nature, investment banks offer a lot of opportunities for learning and skill-building, in the areas of business and finance. The trade-off, however, you will need to be able to cope with stress, long hours and thrive in a competitive work environment to become an investment banker.

Investment banks are usually categorized by the size of deals they negotiate, their geographical location, their areas of expertise, and the type of financial services/products they offer. The investment banking landscape is fairly complex by a range of different business models. Nevertheless, investment banks are generally identified in one of the following categories:

Typically, large investment banks work through voluminous groups, covering a range of client-facing or operational areas. However, most firms can be divided into three key divisions:

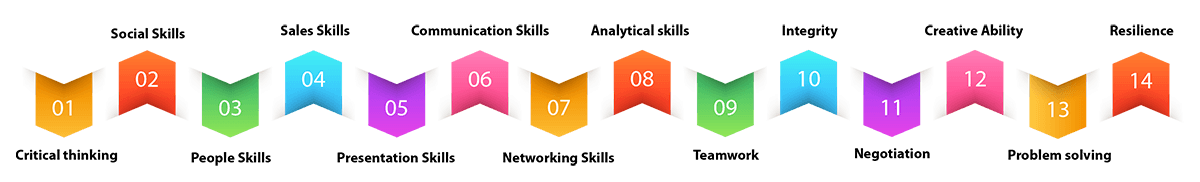

Investment banks employ some of the finest white-collar talents from business schools, and the bare minimum expectation – besides the pedigree – is a combination of strong analytical and interpersonal skills

Indeed, specific skill-set demands vary across jobs and roles – brokers need to have killer sales skills, whereas, equity analysts would demand both analytic and interpersonal skills. It is very important to have a deep understanding of the financial markets.

Though only the very best of the talents eventually make it into the best investment banks, to be fair, even rookie-undergrads are let in by them to join the Analyst roles. MBAs join a rung higher – as associates. Analysts and associates work within specialized groups (domains or horizontals) but they may not always have control over the group to which they get assigned (analysts especially).

Exploring a future in Investment Banking? No matter where you are in your career, we'll guide you to take the right next step.

Talk to Program AdvisorTo help you envision your career path in this field, it is vital to understand the leading roles and their contributions to the overall hierarchy. The steps of IB hierarchy include these roles:

Administrative Responsibility: Low

Salary Range: $50,000 - $60,000 Per annum

Time to Next Level: 2+ months

Summer analyst responsibilities include developing client presentations, gathering information, building financial spreadsheet models, working on various projects to support client relations, and assisting banking teams with day-to-day responsibilities.

The responsibilities of a summer associate are similar to that of a full-time associate in the Division. Summer associate mostly works with a product group or industry group on a variety of client and deal assignments throughout the summer.

Administrative responsibility: Low/Medium

Salary Range: $100,000 - $150,000 Per annum

Time to Next Level: 3+ years

The responsibilities of an Analyst are to help with project work, develop and prepare marketing presentations, analyze client equity and fixed income portfolios, research current trends and assist with trading and offer general client service and team support.

Administrative responsibility: Medium

Salary Range:$110,000 - $300,000 Per annum

Time to Next Level: 3.5+ years

Over a three-and-a-half-year period, the associate will be exposed to transactions in many areas, across different industries, regions, and products, all the while developing banking and managerial experience that will prepare them for senior deal management. Day-to-day responsibilities might include planning, structuring, and executing financing transactions in the public and private markets, advising corporations on mergers and acquisitions, and devising and executing strategies that enable companies and institutions to capitalize on the value of real estate assets.

Administrative responsibility: High

Salary Range: $150,000 - $450,000 Per annum

Time to Next Level: 3+ years

The primary role of the Vice President is to be the “project manager,” whether for marketing activities or on a transaction. It is the VP that typically decides the structure of the presentation (e.g. a pitch book). On live engagements, the VP is typically the banker “running the deal.” The VP must manage clients and guide internal resources to handle transaction implementation across industry groups. It is often at the VP level that bankers begin to form valuable relationships with clients.

Administrative responsibility: High

Salary Range: $250,000 - $1.5 Million Per annum (include bonuses)

Time to Next Level: 2 years (sometimes indefinite)

The Director or SVP may either act more like a Managing Director (play a high-level client development role) or more like the VP (play a project manager role). Sometimes, the Director/SVP’s role will depend also on the specific situation and/or other deal team members. Ultimately, for Director/SVPs to be promoted to Managing Director, they will have to demonstrate that they can form client relationships and have the ability to market and bring in new business.

Administrative responsibility: Very High

Salary Range: $500,000 - $ 4 Million Per annum

(Gross Income may hit $10 Million)

The managing director spends time winning deals and clients, developing relationships, meeting companies, and providing direction and vision to team members for management presentations and client pitches. They act as the primary contact and advisor to targeted client groups. A Managing director is responsible for winning most capital markets, M&A, restructuring deals, which means they are responsible for investment banking revenue.