Expansion in contemporary finance is not about raising capital or reducing expenditures, it depends on the efficiency of the way organizations deal with liquid assets. Liquidity management is what makes a company stable when the market is fluctuating, and more so, it provides it with the flexibility to pursue new opportunities. Whether expanding operations and supporting mergers to cushion against sudden shocks, the manner in which liquidity is managed dictates the resilience and future-focused nature of a business.

A good liquidity management plan is not merely about the bills being paid. It is also about having a business prepared to act promptly when opportunities emerge and challenges arise. A stable liquidity base provides companies with the flexibility to stand firm and help with growth.

With liquid assets readily available, companies can:

Effective liquidity management involves achieving the appropriate trade-off between risk reduction and return retention. According to a recent study conducted by the Federal Reserve Board and partners, in times of weak non-bank funding, e.g., due to such a policy as quantitative easing, banks change their funding composition and credit supply to protect liquidity. Banks that are more exposed become insured deposits and lower undrawn credit lines. Such measures can reduce short-term growth but stabilize it and eventually promote sustainable returns.

Key components of smart liquidity practices:

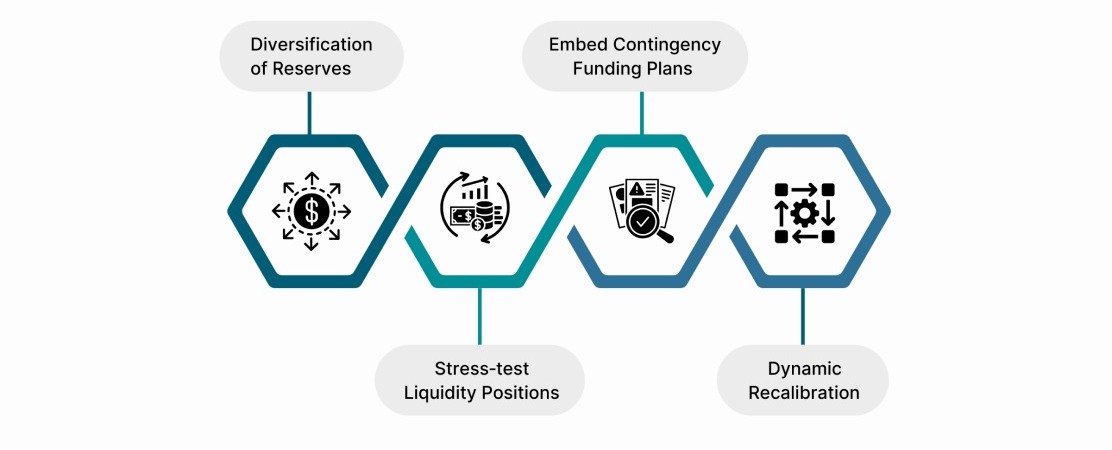

Intelligent implementation enables a company to fulfill its commitments and maintain the long-term payoffs. Liquidity analysis has evolved, as the FDIC notes, with forward-looking cash-flow models and contingency-funding plans becoming the standard tools that modern banks use to remain strong through the lightning-fast changes.

A liquidity buffer is flexible and acts as a buffer and also as an enabler of growth. It enables organizations to react fast to unforeseen upheavals and retain capital to use opportunities that have strategic value. In contrast to a static reserve, a dynamic buffer will adjust to market conditions, the changes in regulations, and the changing financial priorities of the company.

A strong buffer does not merely consist of the retention of idle cash, but the organization of liquidity in order to achieve maximum agility. The Bank of International Settlements (2023) concluded that firms that have diversified liquidity reserves are 28% more prone to survive market shocks compared to those with narrow holdings. This highlights the need for a systematic and yet adaptable strategy.

The combination of modern technology tools with a liquidity-management strategy provides finance teams with real-time visibility and an opportunity to predict cash-flow fluctuations before they occur. Organizations are no longer using the old spreadsheets but are shifting to the dynamic models that inject structure and foresight into treasury operations.

Recent studies underscore this shift: According to the 2025 Global Treasury Survey, 74% of treasury functions are currently planning to utilize AI, particularly machine learning and predictive analytics, to enhance cash visibility, forecasting, and the detection of anomalies. Nonetheless, a relatively low age of 26% of individuals perceive their AI capabilities as moderate or very mature, which leaves much to be desired.

These tools deliver key benefits:

They allow teams to model various market conditions, best, worst, and average, so they can observe how liquidity will behave under each condition.

Systems identify abnormal variances as they occur, accelerating the process of detection of anomalies and bridging liquidity planning gaps.

Effective liquidity management isn't just about holding cash, it's about matching available funds with strategic capital decisions, ensuring resilience without sacrificing growth. When companies design liquidity in a planned manner, they build the ability to take up high-value opportunities without losing financial freedom.

Key considerations include:

According to a recent survey by AFP underwritten by Invesco, 61% of organizations continue to rank safety as their priority investment in the short term, which highlights the importance of secure liquidity even though firms are attempting to grow by allocating capital. Safety-opportunity balance, when managed effectively, doubles security and strategic flexibility.

Operating in a liquidity management strategy across borders implies the management of more than one currency, time zone, and regulation simultaneously. To make payments, institutions are forced to maintain liquidity in multiple currencies. As of Q4 2024, cross-border bank credit to the world was stable at approximately US$32.6 trillion; however, loans to non-bank financial institutions were substantially reduced, indicating how vulnerable international liquidity is to market changes.

Here’s what makes cross-border liquidity especially complex:

Liquidity management does not just protect balance sheets but puts businesses in a position to be innovative, adaptive, and competitive with confidence. A proactive liquidity management policy helps companies finance new projects, consolidate capital, and address weaknesses associated with changes in the global markets. Combined with risk management in investment banking, it is being used to turn liquidity into a powerful tool, which brings about stability and continues to grow the market both locally and beyond.