Money operates silently behind the scenes in any economy, facilitating trade, settling debts, and sustaining financial systems. This motion is brought to light by the money market. It acts as the center of short-term lending and borrowing, whereby liquidity flows. The market provides an interconnection between governments, corporations, and financial institutions through a trust network and time. It is important to understand structure and functions of money market to appreciate why it is necessary for the stability and growth of the economy.

Money-market instruments in a financial system play a major role in ensuring that short-run stability is maintained because they balance temporary cash surpluses and deficits. The market allows banks, corporations, and government bodies to handle day-to-day funding and liquidity in an effective manner. The parties that have surplus funds can be tapped by the others that have short-term commitments, and they keep the system flowing and responsive.

The major processes of this central action are:

As an example, the short-term funding market was essential in 2025. It was observed, in one study, that money markets are vital in liquidity management as banks and nonbank clients rely on them for rebalancing their liquidity.

This stabilizing effect explains how the money market helps in the stabilization of the wider financial system, minimizing the risk of cash-flow crises, and increasing confidence in operations.

Price discovery and the setting of interest rates, in the context of money-market functions, are the key central mechanisms that drive the broader financial system. A market offers a platform in which the price of short-term funds is arrived at through the supply and demand among the banks, governments, and even large institutions.

Collectively, these operations assist the financial system on both counts. They allow the efficient distribution of short-term funds, and secondly, they allow lending and borrowing conditions in other parts of the economy to reflect the underlying costs of funds. The benchmarking role of the money market thus plays a significant part in the transmission of interest rates to the various sectors.

The money market provides essential short-term funding that keeps trade and business operations running smoothly. Corporations are usually subject to these mismatches in cash-flow timing, such as paying suppliers or labor waiting to receive payment in the form of receivables. The money market provides products that enable companies to fill such gaps, ensuring the continuity of working capital as well as operations without long-term debts.

Practically, this is played out in several ways:

The companies can escape committing themselves to extended maturities or rising financing expenses through these channels. They also enjoy the flexibility and liquidity of the money market by matching the time of funding with the time of operation, and this is the essence of the money market in assisting trade and business operations.

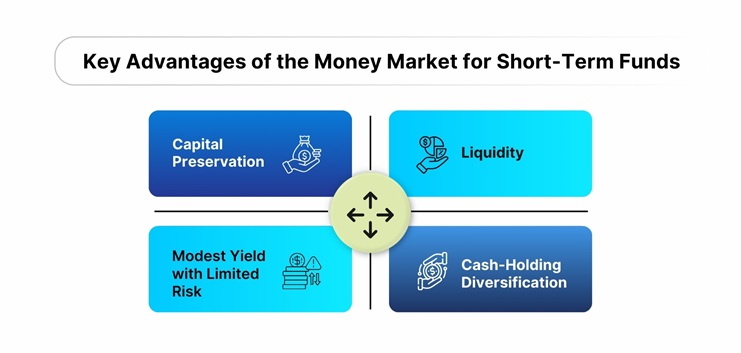

When investors need a steady place to park cash with limited risk, the money market serves as a reliable option. Its structure is built around short-maturity, high-quality instruments that help preserve capital while keeping funds accessible for near-term use. This makes it a practical choice for individuals and institutions to manage temporary cash balances.

Major benefits of the money market as a short-term investment:

Money markets play a fundamental role in carrying out the monetary policy and maintaining a stable economy. Central banks manipulate the liquidity in the entire financial system by regulating the supply and price of short-term funds, influencing credit availability. This allows policymakers to manage inflation and economic growth without necessarily having to interfere with long-term markets.

Key mechanisms include:

The operations of the money market are the basis of contemporary financial stability, providing the stability of liquidity, influence of short-term rates, and facilitation of effortless business and government financing. Its networked design facilitates efficiency, institutional trust, and responsiveness of capital flows to market demands. The money market is also important, as it has the capacity to evolve continuously and maintain economic growth and financial robustness across the globe.