The emergence of real-world asset tokenization is transforming our concept of ownership, value, and access. By converting physical assets into digital tokens, it’s blurring the lines between traditional finance and blockchain innovation. The change alters the liquidity, participation, and transparency among the markets. Tokenization is an emerging interface between real and internet economies, as institutions and investors explore novel forms of operation.

In its simplest form, tokenization of real-world assets is the conversion of ownership or rights of physical or financial assets into digital tokens on a distributed registry. These are verifiable claims, which are represented by tokens. Basically, a portion of a commercial property, part of a work of art, or part of a debt instrument can be acquired, disposed of, or traded in a more flexible and open way.

Key features include:

According to the “Real-World Assets in On-Chain Finance Report,” the tokenized RWA market constituted approximately USD 24 billion in 2025, which tells of the rapid transition from niche pilots to the real scale.

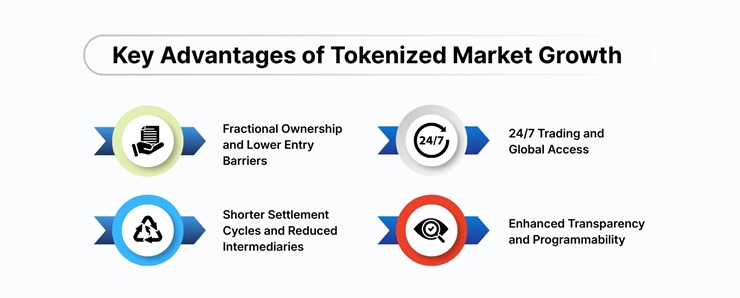

All these factors imply that formerly geographically constrained, entry barrier-heavy, and long settlement cycle assets can now be designed, accessed, and exchanged more fluidly. The underlying asset risk is not eliminated during the transition. However, the essence of ownership, access, and liquidity can now be modeled differently.

The impetus toward tokenization of real-world assets indicates a paradigm change in the operations of financial markets. This change is fundamentally motivated by three forces, which include broadening access, efficiency in operations, and shifting investor appetite.

1. Broadening Access

Traditionally, only big institutions or high-net-worth individuals had access to assets like private credit, commercial real estate, and government debt. Fractional ownership is feasible with tokenization, and the world becomes global. This provides the new classes of investors and democratization of access to hitherto closed pools. According to a report published in 2025, in the first half of the year, tokenized real-world assets were worth more than USD 23 billion.

2. Efficiency Gains

Long settlement, intermediaries, and high costs are aspects of traditional asset processes. Everything is automated through on-chain workflows, and they are more transparent and can be settled in near real-time. Such enhancements minimize friction and cause illiquid assets to behave more like liquid assets.

3. Appetite for New Models

The conduct of the investor is changing. Liquidity, accessibility on a global level, and programmability are more important than ever. Besides novelty gain, the institutions are venturing into this space to gain diversification, which means an increase in yield. This appetite is demonstrated by an increased market of more than 200 percent in a period of less than a year in the tokenized market.

The digitization of real-life assets is transforming the way investors can access and buy previously illiquid instruments. Markets are made more lenient and accessible to a broader range of participants through converting physical or non-physical resources into digital tokens. According to a recent study, the tokenized real-world asset market increased over 260 percent in the first half of 2025, and total value increased by approximately USD 8.6 billion to over USD 23 billion.

Key benefits include:

The legal framework surrounding the tokenization of real-life assets is becoming clearer, yet quite complicated. Regulators in the United States are working out how tokens that reflect physical or financial ownership should be incorporated into the current framework. One regulator referred to tokenized assets as involving traditional market functions, issuance, trading, transfer, settlement, and ownership records. They even emphasized the role of public in influencing rules instead of issuers and investors taking a gamble.

The main dimensions of regulation and standardization are:

A report by the 2025 World Economic Forum confirms that, though the market on tokenized assets is expanding at a fast rate, complete regulation alignment and internationally recognized standards are still considered as groundwork progress. Overall, the standardization of asset tokenization in the real world requires the collaboration of regulators, standard-setters, and market participants in order to establish structures that allow both scalability and trust.

There are a number of deep-seated operational and technical limitations of asset tokenization into the real world, which transcend regulation. It is still not straightforward to integrate blockchain systems with conventional financial infrastructure because legacy systems do not support tokenized transactions or real-time settlement. This disintegration exists between the digital and traditional asset management processes.

Main barriers include:

The future of tokenization of real-life assets depends on bringing together trust, technology, and regulation. These forces together will create scalable, transparent markets. Tokenized assets will become necessary infrastructure when banks, developers, and policymakers coordinate. The change is not the digitization of ownership itself. It is a reframing of global value movement, with efficiency and accessibility as the governing principles.