Introduction

The private credit market has transformed the way companies secure capital and investors seek returns. It is no longer a silent chamber of finance. The private credit market stands as a strong competitor to the traditional debt market, filling lending gaps left by banks and growing just as big and influential. The overall financial ecosystem is redefining the meaning of modern credit creation as the private lenders invade the traditional niche that investment banks controlled.

Inside the Dynamics of the Private Credit Market

The private credit market is also establishing itself as one of the key non-bank lending platforms. It provides capital to companies without the need to issue bonds to the market or issue syndicated loans. These are customized structures, such as senior secured or mezzanine finance. These bespoke structures enable the borrowers and lenders to strike terms and covenants and collateral in a way that is not possible in the traditional publicly traded debt.

The major differences as compared to syndicated loans or high-yield bonds are:

-

Flexibility in structuring: Transactions are not made by standardized terms but through negotiations.

-

Direct lender: Borrowers and lenders enter a more intimate long-term relationship.

-

Limited liquidity: Such loans are normally in the form of maturity and are not listed publicly.

In size, a recent CAIA survey shows that the global private credit sector had approximately US$1.6 trillion in 2025, and the untapped funds (dry powder) were approximately US$500 billion.

This fact highlights not just an increase but also the ability to deploy even more. The form, fluidity, and magnitude of private credit are transforming the way credit intermediaries are run, and they supply capital when conventional financing sources are removed and provide investors with access to comparatively unrelated credit risk.

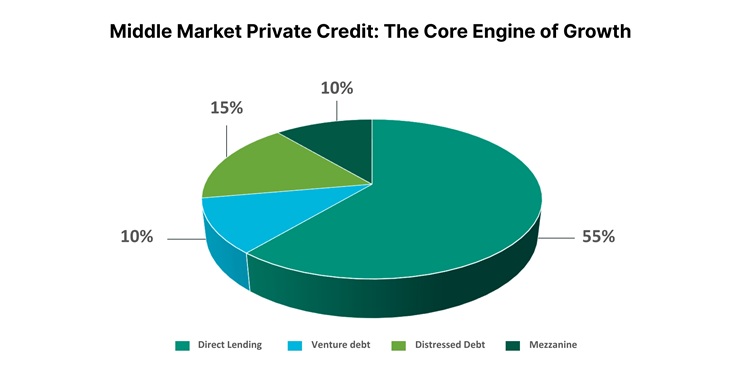

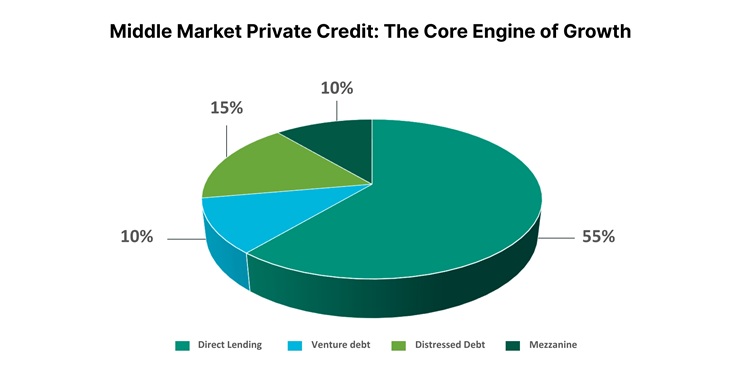

Middle Market Private Credit: The Core Engine of Growth

The middle market private credit is at the center of the growth of private credit in this changing financial environment. This segment fills an important gap for companies that are too large to get loans through small business lending and yet too small to get loans in large capital markets. These firms, in most instances, demand customized financing arrangements that are too risky or too ineffective to be underwritten by traditional banks.

Here’s what makes this segment the engine of expansion:

-

Transaction size and borrower profile

Middle-market private credit deals are typically between US$20 million and US$200 million. Borrowers are usually characterized by already defined cash flows, albeit at the expense of fewer financing options. Privatized credit funds may provide covenants that are flexible, custom repayment terms, or delayed amortization to suit the growth cycle of the borrower.

-

Fund structure and specialization

This is often dominated by closed-end credit funds. Numerous funds focus on industry niches with a great deal of sector knowledge and use of that knowledge to improve underwriting and monitoring. Opaque firms can be screened in a more accurate manner, as the BIS notes, because of this specialization.

-

Market share and direction

According to PitchBook’s H1 2024 Global Private Debt report, direct lending, which is predominantly in the middle markets, contributed 54.9 percent of fund closings in the area of private debt. This engine of middle-market direct lending is in effect, what drives much of the growth in the private credit market.

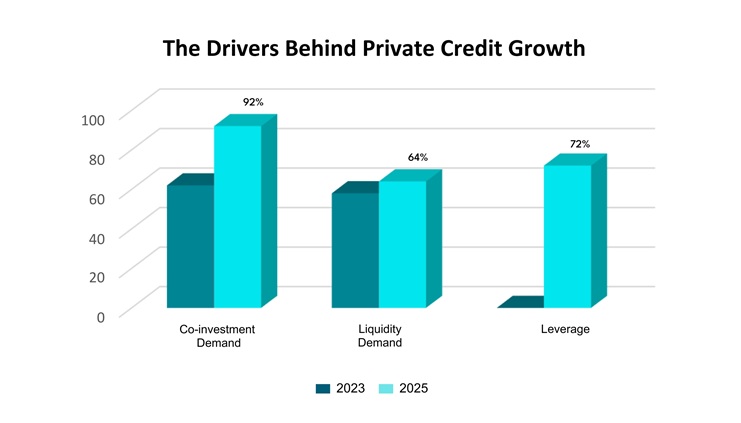

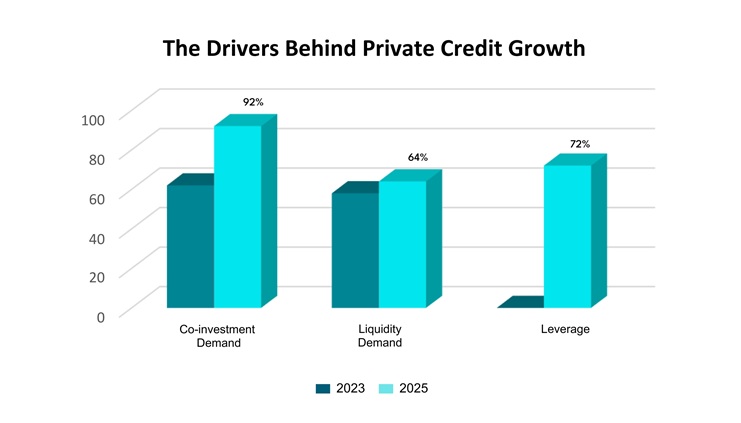

The Drivers Behind Private Credit Growth

The private credit market is being accelerated by tremendous number of drivers. These are not merely financial trends. They capture shifts in regulation, investor behavior, and economic stress spots.

In recent research by AIMA and Dechert, covering US$1.5 trillion in private credit market assets, 92 percent of managers reported increased investor demand for co-investment in 2025. Liquidity requirements also increased, with 64 percent of respondents favoring funds with periodic redemption, up from 49 percent in 2023.

Below are the key drivers:

-

Regulatory pressure on banks: The tightening of capital and risk requirements limits what conventional banks can lend, particularly to mid-sized firms. That gap is filled by private lenders.

-

Investors search for yield and flexibility: Low and volatile interest rates and weak public market returns are attracting institutional investors, pension funds, insurers, and family offices to middle-market private credit to seek stable cash flow and customized terms.

-

Custom fund structuring: In 2025, numerous private credit managers will work on evergreen or hybrid vehicles, rated-note feeders of insurance capital, tiered fees, and increased liquidity choices to satisfy investor preferences.

-

Funding cost convergence: The disparity between the cost of funding loans through private credit and banks is being reduced in most jurisdictions. This decrease in the cost disadvantage contributes particularly to the growth of private credit, especially in those areas where the efficiency of bank lending is lower.

Shifting Power Dynamics: What It Means for Investment Banks

Traditional investment banks are under real pressure from the mounting strength of the private credit market. The U.S. segment alone was projected to be US$1.34 trillion in 2025, with the global assets topping nearly US$2 trillion by mid-2024. The power is shifting as non-bank lenders enter areas dominated by banks.

-

Loss of Fee Pools: The share of leverage-based high-fee lending is getting smaller as private funds are underwriting leveraged acquisitions to a greater extent than banks.

-

Co-Lending & Alliances: Other banks do not have to compete directly, but they enter into co-lending relationships or joint financing facilities with private funds to share capital, risk, and deal flow.

-

Advisory Focus: Banks are using their structuring skills to move into the advisory business, assisting in the deal architecture, due diligence, and optimization of debt as opposed to capital deployment.

-

Capital-Efficiency Imperative: Under tighter capital requirements, banks have reduced the amount they are prepared to place on the balance sheet in the form of big loans. That pushes them into less direct exposures (e.g., syndication, underwriting) rather than direct exposures.

Risks, Regulation, and the Future of Private Credit

The growth of the private credit sector has presented opportunities and weaknesses that require greater control and management of risks. With the increasing growth of middle-market private credit, there is increasing attention from regulators and investors on stability and transparency without sacrificing innovation.

-

Rising Structural Risks

The industry is becoming increasingly exposed to liquidity mismatches, concentrated lending, and valuation obscurity. The long-term, illiquid assets are concentrated in many funds, which have fewer redemption cycles, thus increasing the likelihood of strains in times of market downturns. Systemic risks may also be increased through concentration in cyclical industries and uneven loan valuation practices.

-

Regulatory Evolution and Oversight

The policy makers are demanding more transparent disclosures, frequent stress testing, and consistency in reporting. Other areas are going out and regulating the funds of direct lenders with a focus on governance, capital adequacy, and protecting the investors to limit the hidden leverage and contagion in the market.

-

Transparency and Standardization

Credit managers are embracing the standardized documentation, robust covenants, and independent third-party valuation models to build confidence in the market. Improved reporting and risk analytics are assisting investors with evaluating the resilience of a portfolio and counterparty exposure.

Conclusion

The private credit market has ceased to be a niche financing tool and has become a core of modern finance, transforming the way companies gain access to funds and the way investors invest in companies. Its expansion has changed the conventional investment banking approaches, which promote alliances, co-lending, and new deal designs. In the future, the presence of the two means of private credit and banks is bound to continue as they grow new risk structures, ensuring that more opportunities are offered to both the borrowers and institutional investors.