An IPO is like a negotiated transaction - the seller chooses when to come public - and it's unlikely to be a time that's favorable to you.

-Warren Buffett

Choosing the right underwriters is crucial to the successful structuring and execution of an enterprise’s planned Initial Public Offering (IPO). For a few years, the IPO process was considered as the end goal for startups and high-growth private enterprises. Before an enterprise “goes public,” it is "private," which means it possesses a small number of shareholders and that its shares cannot be bought or sold on public stock exchanges like the NASDAQ or NYSE.

After an enterprise turns into public, a vaster group of individuals and institutions possess its shares. At this time, anyone can purchase those shares on public exchanges, and the enterprise is required to file regular reports about its financial performance.

An Initial Public Offering (IPO) is a process in which a privately held enterprise becomes a publicly traded enterprise by offering its shares to the public for the first time. In an IPO, an enterprise issues the latest share of stock to raise capital, and those shares are then traded on a public stock exchange. This gives the enterprise's ownership to be distributed between a large number of shareholders, which includes individual as well as institutional investors.

An investment bank will likely start its analysis of the business plan, during which it will scrutinize many factors of the business to determine if they are willing to collaborate or not. If the bank trusts that the IPO is feasible then the chances for involvement are quite high. This sometimes also results in the involvement of many other banks as well. This leads to “bake-off,” where multiple banks will pitch their services to an enterprise. Unless the enterprise is a large entity, it will likely require only one lead underwriter.

But there are certain situations where the enterprise chooses joint book-runners—more than one can lead the underwriter. The assumptions for choosing the lead underwriter (usually termed as the “left lead bookrunner”), and the co-lead (or “lead right”). Many times it is equal in economics and authority and is called as “joint lead bookrunners.” This is as a beginning point for the enterprise and its board as it starts the underwriter selection process.

Once an investment bank decides to work with an enterprise, a negotiation process will take place, where many issues are required to be considered, such as the details of the offering, the amount and kind of assistance the bank will offer pre- and post-IPO, and the compensation they will get in exchange.

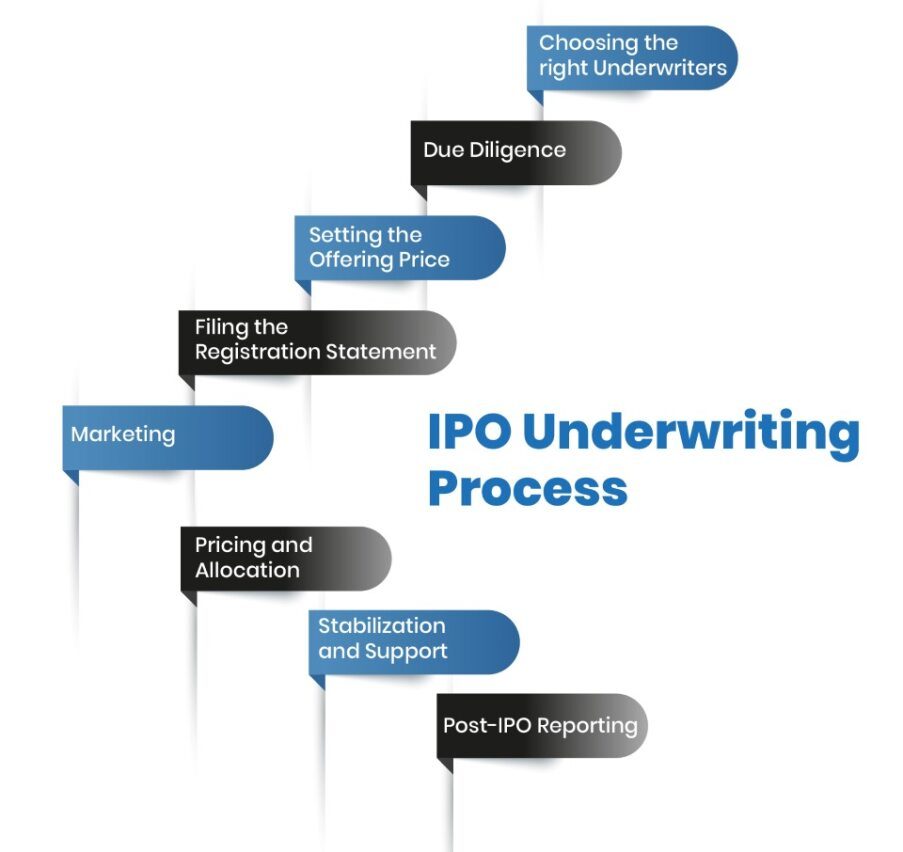

The IPO underwriting process is the set of steps and procedures that an enterprise undergoes to provide its shares to the public for the first time. Underwriting is an essential aspect of the IPO process as it contains the securing of the services for underwriters to help the enterprise rate, market, and distribute its shares to investors.

Essential aspects to consider while IPO underwriting are:

Choosing the right Underwriters

The enterprise is required to choose the investment banks or underwriters which will be helpful for the offering. These underwriters determine the IPO rate, create the prospectus, as well as selling the shares to the investors. They must also research well about the underwriters like:

Due Diligence

The underwriters performs due diligence on the enterprise to review its financial health, business model, and compliance with regulations. This consists of assessing the enterprise's financial statements, operations, management team, and any potential legal or regulatory issues. It is also important to consider the chosen investment bank meets the required demands to qualify as an independent underwriter. Knowing the self-regulatory organization (SRO) the potential investment bank is regulated by, and verifying their independence with the organization’s demands. Many banks usually in USA are regulated by the Financial Industry Regulation Authority (FINRA).

Setting the Offering Price

An underwriter performs tasks with the enterprise to determine the offering price of the shares. They also analyze the current market conditions, investor demand, as well as the enterprise's financial performance to get at a rate that is expected to generate the interest of an investor.

Filing the Registration Statement

With the assistance of underwriters an enterprise files a registration statement with the Securities and Exchange Commission (SEC). This statement consists of detailed information about the enterprise, its financials, and the terms of the offering, which needs to be thoroughly reviewed before proceeding for the next steps.

Marketing

For the generating an interest in the IPO, the underwriters make marketing materials and also offers a roadshow, during this process the enterprise executives and underwriters offer an investment opportunity for the potential investors. They also help for navigating the legal, financial, and marketing factors for the success of the IPO in the public markets.

Pricing and Allocation

After the marketing process is done, the underwriter and syndicate members will finalize the offering price for the IPO, which is mainly dependent on the review process taken from the roadshow and market conditions. An allocation of shares to institutional investors like mutual and pension funds are also done, which are commonly set just before the IPO starts trading on the public markets.

Stabilization and Support

After the completion of IPO underwriting, an engagement is done for the stabilization activities to benefit the stock price, such as purchasing shares in the secondary market to eliminate the excessive price volatility.

Underestimating the Competition

Many qualified candidates are already a part of this industry. And there are only a limited number of positions, mainly in prestigious organizations. Underestimating and thinking that the level of competition is less will usually lead to mistakes in the application as well as in the interview process.

Post-IPO Reporting

The enterprise is now a public entity and is required to be adhering for the ongoing reporting and disclosure demands, such as including regular financial reporting, as mandated by securities regulations. They will close the offer by buying the shares at the offering price and puts them up for sale to the investors.

It's crucial to understand that success can be measured in various ways. A profit-driven IPO is something that aligns with the enterprise’s goals and delivers value to both investors and the enterprise too.

Here are some common metrics that are used for evaluating the performance of an IPO:

Market Capitalization

The IPO is note-worthy if the enterprise’s market capitalization is equal to or greater than the market capitalization of the competitors within the industry with 30 days of the IPO. It reflects the investor demand and confidence in the enterprise’s future prospects.

Market Pricing

The IPO is considered to be affluent if the variation between the offering price and the market capitalization of the issuing enterprise within 30 days after the IPO gets a first-day leap exceeding 20 percent.

Underpricing

Underpricing happens when the offering price is set lower when compared to the first-day closing price. Though it is considered as an achievement for the success to the perspective of investors who get an instant profit, it might also indicate that the enterprise had chances to raise more capital as well.

Trading Volume

A healthy trading volume on the first day and in the weeks following the IPO showcases that there is a strong investor interest followed by liquidity. If there is high trading volume then it is considered as a sign of achievement.

The success of an IPO underwriting process is mainly dependent on selecting the right underwriter. Several enterprises usually consider the aspects like reputation, quality of research and industry expertise in an investment banks to proceed further with. Several important decisions are made during an IPO, but with the proper care and effort, both the underwriter and enterprise can reap great benefits and rich returns.

Q1) What is an IPO process?

A) An IPO process consists of five simple steps, where the process involves happening from six months to over a year to complete. The steps are as follows:

Q2) How long does the IPO take?

A) To process the IPO, it takes lots of effort and time. But if the team managing the IPO is done in an organized way, hence it takes around only six to nine months for the enterprise to finish off its task to be a publicly listed entity.