Introduction

Case studies are a particularly beneficial and essential tool in investment banking, as they provide insights into the processes and approaches employed by financiers in mega transactions. By studying actual cases, it is possible to determine the implications of mergers, acquisitions, initial public offerings (IPOs), and restructuring skills in the investment banking sector. These cases not only enable current borrowers to enhance their evaluation skills but also provide the learners with learning opportunities to practice banking skills in a constantly changing environment.

The Anatomy of an Investment Banking Case Study

An investment banking case study employs a systematic approach to explain the details of a specific financial transaction and the bank's role. The purpose of a case study is to depict the window of analyzing and dealing with an investment banking deal.

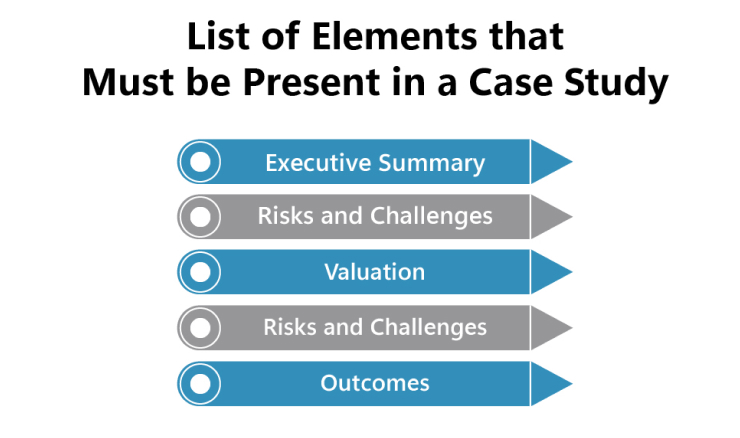

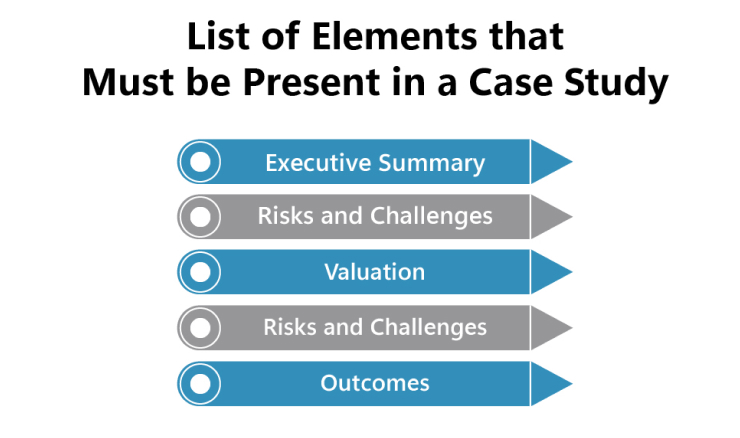

The following is a list of elements that must be present in a case study:

-

Executive Summary: Brief details of the deal with its strategic importance in the business, some of the main financial factors, and some parties involved. This serves as the background to the entire study, providing context and background information.

-

Valuation: This section further analyzes the organization’s value using various methods, including the (DCF) Discounted Cash Flow method, precedent transactions, and comparable companies. Evaluation is paramount in ascertaining whether a deal shall be financially viable or not.

-

Strategic Rationale: Examines the reasons behind the transaction, including growth opportunities in the market, mergers, or other sources of gains. This part typically assesses the role of the deal within current industry trends.

-

Risks and Challenges: This encompasses financial, operational, and regulatory risks, which are potential barriers to the deal's success. Identifying such risks is useful for bankers to suggest how the risks can be managed.

-

Outcomes: The consequences of the transaction, especially regarding impacts on the company’s financial performance after the transaction, and whether it has achieved the strategic goals. It is also a resource that provides an evaluation of the long-term impression on stakeholders.

Example 1: Mergers & Acquisitions — Disney’s Acquisition of 21st Century Fox

In March 2019, The Walt Disney Company completed its US$ 71.3 billion acquisition of 21st Century Fox, marking a significant milestone in the entertainment industry. This was a strategic move aimed at diversifying Disney's content and integrating it into the international market, particularly the streaming market.

Key Deal Components:

-

Valuation & Synergy Estimation: Investment bankers conducted a detailed appraisal of Fox’s fixed assets, including the company’s movie production facilities, television broadcasting stations, and overseas subsidiary corporations. These expectations were expected to increase Disney’s content services and workflow capabilities.

-

Regulatory issue: To address the antitrust concern, Disney was required to divest Fox’s regional sports network, comprising 22 channels, as mandated by the U.S. Department of Justice regulations.

Core Investment Banking Skills Demonstrated:

-

Due Diligence: Systematic risk analysis of the several media properties of Fox, which was necessary to discover any issue that would deter an investor.

-

Market Conditions: Bankers utilized market intelligence to analyze industry factors and competition, enabling them to predict the performance of the merged entity.

-

Negotiation & Deal Structuring: Structuring a deal that satisfies the needs of both parties entails rigorous negotiations and an understanding of various types of financial instruments.

This acquisition, in addition to expanding Disney’s content portfolio, also helped the company establish itself as a significant market player in the global media market. The transaction demonstrates that investment bankers play a crucial role in connecting relevant and potentially productive companies to facilitate mergers and acquisitions.

Example 2: Initial Public Offering — Rivian Automotive IPO

Rivian Automotive launched its initial public offering on November 10, 2021, in the electric vehicle (EV) industry. The company decided to offer it for US$ 78 per share, which was higher than the initial range of US$ 57 to US$ 62. It sold 153 million shares, thereby garnering approximately US$ 12 billion. When it started trading, the stock skyrocketed 29% and closed at US$ 100.73, resulting in a total valuation of nearly US$ 100 billion, surpassing automotive giants such as Ford and General Motors.

The following are the roles of investment bankers:

-

Market Timing: To fully capitalize on the recently rising interest in EVs among investors, they strategically timed the IPO for when the market was most favorable.

-

Roadshows: Organizing comprehensive presentations to potential investors, they effectively communicated Rivian's vision and growth prospects.

-

Pricing Decisions: They used an upward review of the shares’ price to attract many investors, resulting in optimal capital being raised without compromising on investor returns.

These are some of the fundamental investment banking skills:

-

Equity Research: Conducted detailed analyses of Rivian’s production capabilities, pre-order volumes (notably 55,400 pre-orders for the R1T and R1S models as of October 31, 2021), revenue forecasts from commercial vehicle contracts, and evaluated long-term growth potential in the EV and delivery markets.

-

Capital Raising: Structuring of the offering to achieve the optimum dollar amount while at the same time maintaining investor confidence.

-

Investor Relations: Information and persuasion to create trust and desire to invest among shareholders.

Rivian’s share price was rather volatile after it went public, due to the difficulties that entrants often face when trying to ramp up production and meet delivery targets. However, the IPO's success demonstrated that investment banking skills indeed remain indispensable amid sophisticated financial structures, while also boosting IPOs to great heights of capital achievement.

Example 3: Debt Restructuring — Hertz Global Holdings During Bankruptcy

Hertz Global Holdings filed for Chapter 11 Bankruptcy protection in May 2020 due to an equity value of approximately US$ 19 billion and the halt in travel resulting from the COVID-19 pandemic. April revenue decreased to 73% of the previous year's, and the company's growth came to a halt with negative projections on the horizon.

Significant Features of the Debt Management:

-

Debt Elimination: Hertz successfully eliminated more than US$ 5 billion in debt, excluding all corporate-level financial obligations in Hertz Europe.

-

New Equity Capital: The company has also secured more than US$ 5.9 billion in new equity capital from investors, which is crucial for its reorganization.

-

Enhanced Liquidity: Hertz announced a new US$ 2.8 billion exit credit facility, comprising an undrawn US$ 1.3 billion credit facility and a US$ 7 billion asset-backed vehicle financing facility.

Investment Banking Skills Demonstrated:

-

Financial Modeling and Analysis: Investment bankers also tested the effectiveness of the company’s debt model and designed the optimal restructuring model.

-

Negotiation and Deal Structuring: Bankers were actively involved in the negotiation process with creditors regarding the new equity capital and financing facilities.

-

Risk management: Several financial and operational risks related to the company's future sovereignty had been analyzed and managed throughout the restructuring process as a result of the bankruptcy.

Example 4: Cross-Border Deal — Tata Motors Acquiring Jaguar Land Rover

In 2008, Tata Motors, a leading Indian automotive manufacturer, acquired the British luxury car brands Jaguar and Land Rover (JLR) from Ford Motor Company for approximately US$ 2.3 billion in an all-cash transaction. This strategic move marked Tata Motors' significant entry into the global luxury automotive market, highlighting the complexities inherent in cross-border mergers and acquisitions.

Key Deal Considerations:

-

Geopolitical Complexity: The acquisition entailed dealing with different regulatory systems of the two countries, Indian and the United Kingdom. Individuals from investment banking departments were prohibited from engaging in antitrust activities while performing their duties and from obtaining government permits, which facilitate efficient transactions.

-

Due Diligence Across Jurisdictions: The acquisition of JLR required extensive cross-border due diligence, which cannot be overstated, as it entailed financial due diligence, brand due diligence, market due diligence, and other necessary forms of due diligence. To avert any missteps, bankers conducted an extensive search for risks and opportunities before advising Tata Motors on the optimal investment approach.

-

Currency Exchange and Risk Hedging: Foreign exchange was a significant concern, given that the deal involved cross-border operations. The exchange rate risk was quite apparent for this type of transaction, but investment bankers ensured that derivative tools were employed to mitigate any potential losses.

Role of Investment Banking in the Tata–JLR Acquisition:

Tata's acquisition of JLR was facilitated by investment banks, which offered a range of services to make the deal possible.

-

Financial Advisory: Some of the leading global investment banks served as the primary advisors for the deal, offering guidance on valuation, deal structure, and negotiation techniques, including Citigroup and J.P. Morgan.

-

Financing Arrangements: Regarding sources of funds for the acquisition, Tata Motors secured a US$ 3 billion bridge loan from a syndicate of banks, with intermediary financing personnel arranging the loan to align with the company’s socioeconomic scenario and financial plan.

-

Legal Issues: Investment bankers consulted with lawyers to address compliance issues related to the countries’ laws, enabling them to work more efficiently within the legal frameworks of each country.

Conclusion

Investment banking case studies remain one of the most effective ways to gain a deeper understanding of these complex financial strategies and deal execution. They provide exposure to real-life solutions for decision-making processes, strategic planning, and risk management, as well as the general subject matter of investment banking. These case studies remain essential teaching aids for building analytical skills, systematic thinking, and professional experience that the upcoming generation of bankers needs in an emerging and dynamic industry.