Introduction

Free cash flow is a key financial measure in the value relevance analysis that unveils the actual financial health of a business organization beyond the bottom line. While net income already considers non-cash expenses, free cash flow refers to the real net cash one has after paying for capital investments. Calculating free cash flow has become widely used, especially among investors and analysts, to analyze the company’s financial health, growth prospects, and operating efficiency. Understanding how to calculate free cash flow and interpreting its implications is essential for investors, managers, and analysts aiming to make informed financial decisions.

What is Free Cash Flow?

Free Cash Flow (FCF) measures the amount of cash available to the total business after all the capital investments needed for the firm have been considered. While net income considers non-cash expenses such as depreciation, free cash flow highlights the actual cash that can be given to shareholders or used for reinvestment. It helps assess a company’s working performance, business output, and financial stability.

Key Points include:

-

Free cash flow vs. net income: Net income generally illustrates a business's fortunes. In contrast, free cash flow is more specific, revealing a business's ability to generate liquidity from functioning operations.

-

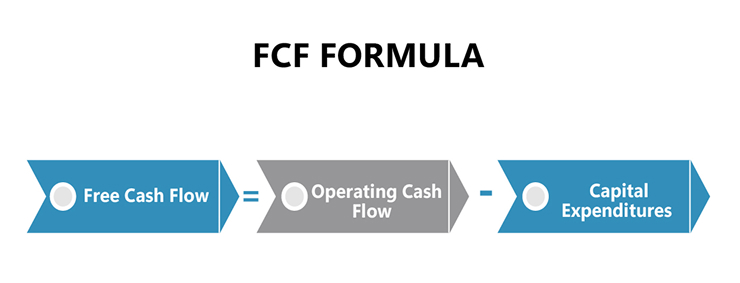

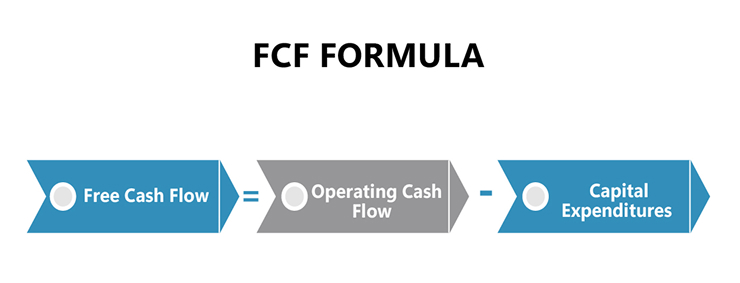

Cash Flow from Operations: Operating cash flow (OFC) is the first component of free cash flow, which calculates cash flow from operations, that is the cash generated by businesses daily.

-

Capital Expenditures: Capital expenditures (CapEx) are deducted from operating cash flow because they are funds spent on acquiring or improving long-lived assets like equipment and properties.

It is preferred over net income as it demonstrates actual cash availability and patterns, not merely accounting changes. A high or positive FCF represents a good cash position capable of funding expansion, paying off debts, or distributing profits in the form of dividends.

Why is Free Cash Flow Important?

Comprehending the principles behind free cash flow (FCF) to evaluate a firm’s profitability and productivity is crucial. It is the cash a firm has available for investment after paying operating expenses and purchasing capital goods. It represents both the cash inflow and outflow, which enables understanding of cash available for investments in improved operations, debt paydown, and returns to shareholders.

The measure of Free Cash Flow (FCF) offers several key advantages, including the following:

-

Indicator of Financial Health: A business generates enough cash for operation and investment without borrowing or seeking other sources of funds. On the other hand, negative FCF may point to a threat, as it could mean the company needs to access capital or credit markets to finance its operations.

-

Investment Evaluation Tool: Investors sometimes use FCF to measure a company's worth and potential returns. Positive and rising FCF means better operating efficiency and more cash that can be distributed to investors through dividends or share repurchases.

-

Debt Management: Firms with large amounts of FCF can proficiently address and control debt. The excess cash will reduce interest costs and improve the company's credit ratings, which will mean better interest rates in the future.

-

Funding for Expansion: FCF helps fund a business’s sustained growth without seeking additional financing. Being self-sufficient can be very beneficial, as it can help with strategic growth management while avoiding financial instabilities.

The Basics of Financial Statements for Free Cash Flow Calculation

Evaluating FCF requires precise interpretation of the various forms of financial statements. Every statement provides data that, when assessed in synchrony, presents a complete picture of a company's financial health and ability to generate cash.

1. Income Statement:

-

Purpose: Conveys the operational revenues and expenditure of the business over a certain period to arrive at net profit.

-

Relevance to FCF: Net income considers profitability; nonetheless, it contains non-cash expenses such as depreciation and amortization, thus, it needs adjustment to determine cash flow rigorously.

2. Balance Sheet:

-

Purpose: Presents a snapshot of a company's assets, liabilities, and shareholders' equity at a given time.

-

Relevance to FCF: Working capital items, which include accounts receivable, inventory, and accounts payable, affect the amount of cash available at any given time and are also a component of FCF.

3. Cash Flow Statement:

-

Purpose: Presents a clear outline of inflow and outflow of cash from various activities, such as operating, investing, and financing activities.

-

Relevance to FCF: The operating activities section shows cash produced from various activities, which is the basis of the FCF calculation.

To compute FCF:

-

Operating Cash Flow (OCF): Start with the net cash provided by operating activities as per the cash flow statement.

-

Capital Expenditures (CapEx): Deduct cash spent for property and equipment acquisition, as noted in the statement of cash flows.

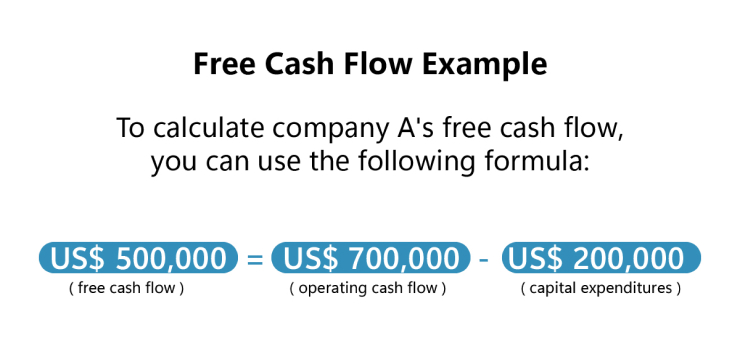

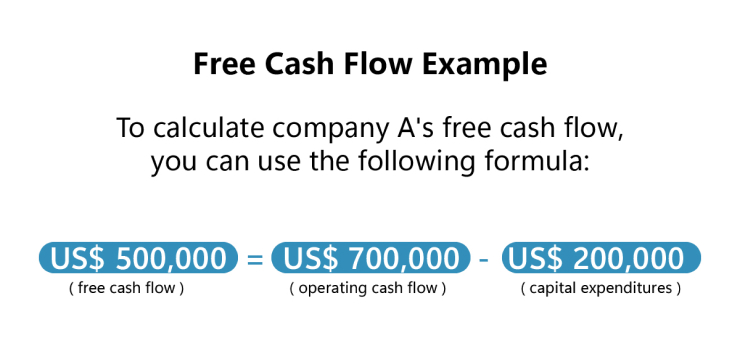

Example:

Consider a company with an operating cash flow of USD 700 million and capital expenditure totaling USD 200 million.

FCF= USD 500,000= USD 700,000 -USD 200,000

This USD 500 million represents the cash available for debt repayment, dividends, share buybacks, or reinvestment into the business.

Key Considerations:

-

Periodically reviewing these statements allows an adequate understanding of the company's cash flow.

-

OCF and CapEx analysis may offer more insight into operations and investing.

-

Practical knowledge on how net income, non-operating accounting adjustments, and working capital behavior interact is key to generating FCF figures.

Real-World Examples of Free Cash Flow

FCF includes the cash generated from operations and net investments, an essential measure of financial performance. To forecast FCF, one must refer to the Firm’s financial statements, particularly the Cash Flow Statement and Balance Sheet.

Industry Examples:

-

Technology Sector: Apple Inc. is one of the exemplary companies that consistently generates FCF. For fiscal year 2022, its operating cash flow was USD 119.7 instead of USD 11.6 in capital expenditures, giving it a free cash flow of USD 108.1.

-

Energy Sector: The industry is highly capital-intensive, and Exxon Mobil Corp., therefore, has high capital investments. Nonetheless, Exxon has sustained positive FCF to pay its shareholders' debts and dividends.

-

Consumer Goods Sector: Nike Inc. successfully managed FCF; Nike generated an operating cash flow of USD 5.2 billion while investing in its fixed assets through capital expenditures of USD 758 million, resulting in FCF of USD 4.4 billion.

Interpreting Free Cash Flow: What Does It Mean to You?

Calculating free cash flow is difficult, but reading the result is the key to creating better financial understanding. FCF gives insight into a firm’s operational performance for current and future periods, capacity to meet future obligations, and return cash to shareholders.

Below are the varying states of FCF when used in the formula:

-

Positive Free Cash Flow means the company produces more cash flow than it uses in its operations. This cash flow can be used for research and development, paying off debt, shareholders’ dividends, or buying back the company's existing shares.

-

Negative Free Cash Flow is not necessarily a bad sign for a business—it may also happen when a company is in its growth period and is investing significantly in its fixed assets to expand. Nevertheless, negative and repeated FCF may indicate poor financial health or inefficient operations.

From a strategic perspective, FCF offers clues about:

-

Debt Management: Strong FCF supports better credit worthiness and repayment capacity.

-

Shareholder Value: Companies with steady free cash flow tend to provide better shareholder value.

-

Reinvestment Capability: High FCF implies that the company can invest in new product development or extend capacity without going for new sources of funds.

Conclusion

Knowledge of free cash flow computation enables stakeholders to assess the firm’s capability to finance needs, reinvest, pay down debts, and pay dividends. Free cash flows and their interpretation give analysts insights into a company’s financial reality when all the other value drivers have been stripped down. Thus, learning to estimate free cash flows contributes to the enhanced strategic planning and fact-based long-term forecast for a business’s success.