In the current environment of deal-making, the ability to achieve success frequently depends on the quality of M&A due diligence preparation. It is no longer a box to check before closing; it is now a strategic exercise that uncovers opportunities and risks that exist behind the numbers on the surface. Markets are becoming dynamic, and competition is high, and businesses require clearer insights. A properly conducted due diligence procedure today combines competitive research, technology evaluation, and prospective planning to produce more powerful, more durable deals.

The early 20th-century investment banks were more concerned with underwriting securities and facilitating infrastructure growth, hence, acted as a key intermediary between corporations and the capital markets. Now, the post-World War II period was marked by industry in terms of its growth and innovativeness: investment banks became international, diversified their services, and contributed to post-war reconstruction:

These trends set the stage for what is now seen today in M&A in investment banking, where it encompasses a profound combination of strategy, international scope, and financial engineering.

Competitive intelligence can do more than just inform strategy. It provides a foundation on which to base intelligent M&A due diligence. It is about detecting the threats in advance and going on offense.

This is how competitive intelligence can be done cleanly and freshly:

Identify the key players, their relative size or market share, and whether they are making progress. This work prepares the ground for meaningful comparison and informed risk assessment.

The market can change, tech can change, or regulation can change, so it can shift quickly. Perusing through them can reveal threats or loopholes that might otherwise go undetected.

Competitive awareness assists in identifying whether the pricing of a target is reasonable, whether its growth can be sustained, and where it compares strategically. It is not just number-crunching, it is strategic clarity.

Going beyond the figures, contemporary M&A due diligence encompasses a few non-financial aspects. Each has a different role in uncovering latent value and testing resilience. Here is a more sophisticated version:

This future-oriented layer examines the process of transformation of inputs into outputs. It evaluates the effectiveness of the processes, supply-chain resiliency, workforce plan, scalability, and sustainability of operations. It also reviews risk mitigants and where post-deal value can be achieved.

All contracts, regulatory requirements, and pending cases are examined here. Having transparency into the governance, regulatory compliance, and legal liabilities protects the deal against downstream surprises and liability exposure.

System robustness, data protocols, and infrastructure are all put under scrutiny. This layer determines whether the technology will enable a smooth integration and the ability to scale in the future without latent cyber-risks or inefficiencies.

It is not only structures but also people. This review looks at leadership competence, employee turnover risks, cultural fit, and employee engagement. Cultural friction is usually mentioned as one of the main factors of integration failure.

According to recent data from Deloitte, roughly 70 percent of M&A deals fail to deliver the value they promise, most often because of poor integration or misjudged human and cultural dynamics.

Technology has become a game changer in M&A due diligence processes, with accuracy and speed of execution now being key factors in an area that was once very manual. The contrast is tremendous. Deloitte's case study claims that generative AI can enhance due diligence efficiency by up to 75 percent compared to the traditional due diligence process. In the meantime, the survey results indicate that there are almost no changes now, as only 16 percent of M&A professionals use generative AI, but the forecasts are optimistic, with estimates of 80 percent adoption in three years.

Why tech matters now:

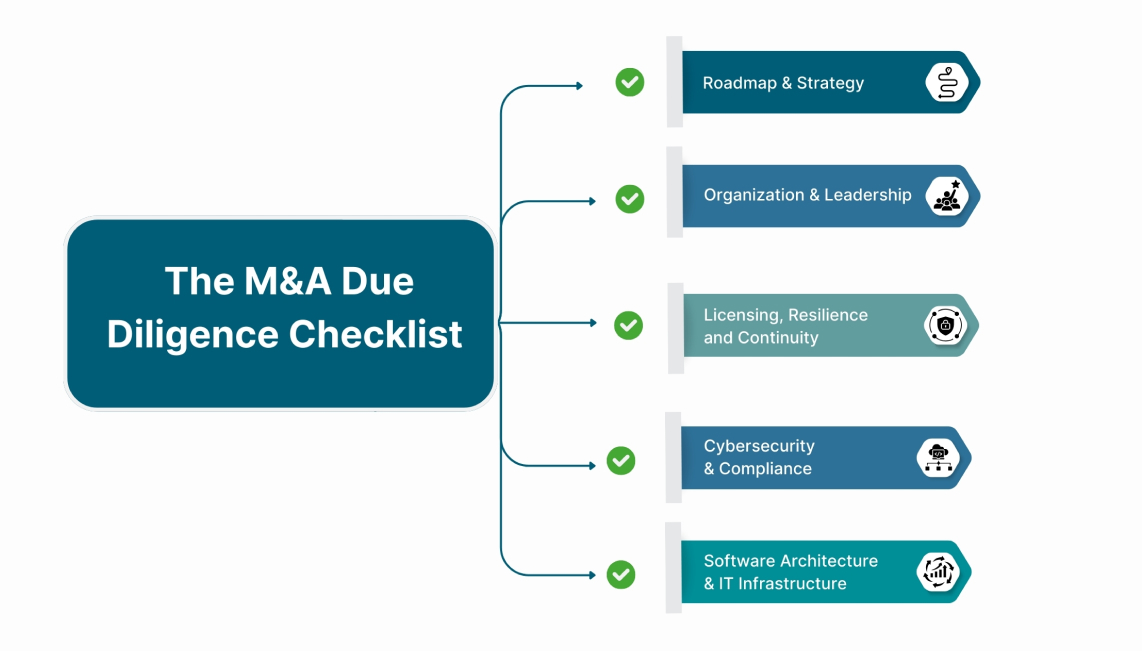

Technology due diligence is more than checking boxes. It makes it easier to strike a deal that is not going to spring any leaks in the future. A study by the Harvard Business Review indicates that firms that perform detailed technology due diligence are 28 percent more likely to achieve post-deal success objectives. The checklist must unfold five crucial areas to remain alert and avoid surprises caused by technology:

Important Checklist Elements:

Ensure that the target has a written technology plan that is in line with its business vision, has feasible time frames, and has a defined strategy that fits the market.

See how technology decision-making processes, leadership capabilities, team consolidation, and talent attraction all come into play, all of which are critical to the ease of integration.

Penetration test security measures, breach records, data protection system, and areas of non-compliance, this is essential security.

Assess the system design, scalability, legacy technical debt, and the compatibility of the infrastructure to be merged with the existing systems of the acquirer.

Ensure that all software licenses, hosting requirements, disaster recovery, and business continuity plans are sound and current.

A combination of competitive landscape insights and M&A due diligence refines the decision-making process and enables teams to go beyond spreadsheets and gut-feel and find genuine strategic advantage.

First, this two-fold strategy will considerably lower uncertainty and increase bargaining power. An assessment of market position, competitor abilities, and emerging risks will help acquirers to set more realistic valuations by eliminating overpayment and identifying value levers that others do not notice.

It also allows more intelligent synergy planning and integration. Second, being aware of the moves of competitors, gaps in their products, or market share shortcomings assists in creating post-deal moves that maintain advantage and eliminate risk instead of blind merging.

The main strategic advantages at a glance:

The current realities of M&A due diligence require more than crunching numbers. It requires the incorporation of competitive research, operational, and technology reviews. By augmenting the M&A technology due diligence checklist with the broader market analysis, the acquirers can predict the problems of integration, preserve value, and identify the growth opportunities. To succeed in the new era of M&A in investment banking, organizations must embrace more intelligent, technology-enabled models that approach due diligence as a risk hedge and a strategic growth driver.