Investment Banking is one of the most highly regarded professions within the finance industry. It involves working with companies to facilitate capital financing through investments which are accomplished through activities such as underwriting the issuance of stocks and bonds.

An investment bank indulges in a special type of banking that assists companies, governments, and institutions to raise funds and carry out financial transactions. Investment banks are not like retail banks that focus on individual consumer transactions. Instead, they act as intermediaries between investors, corporations, and other entities. These banks may specialize in certain areas such as mergers and acquisitions or private equity and venture capital.

Young, ambitious, and aggressive finance students often choose investment banking because of the high salaries and abundant cachet. A 22-year old with a bachelor's degree in finance can earn up to six figures within their first year after college.

An investment banker may have many duties in their job description. For instance, an investment banker assists clients in raising capital in the capital market by issuing debt or selling equity. Other job responsibilities include assisting clients in mergers and acquisitions (M&As) and advising them about unique investment opportunities, such as derivatives.

Research, management of projects, and strategic advice are all part of the job description of investment bankers. Their salaries can be some of the most competitive in the world. Individuals, corporations, and government agencies can access a range of financial services from investment banking professionals. Many investment banks have an investment research department or partner with third-party companies to help them analyze and monitor trends in capital markets. This allows them to make strategic financial decisions on behalf of their clients.

The global banking industry was undergoing major changes when the COVID-19 pandemic hit in 2020. Despite measures including social distancing, remote work, and closing commercial activities posing many operational challenges, the global banking industry grew from 84 billion in 2020 to $111.45 billion in 2021. This growth is mainly due to companies restructuring their operations and recovering from COVID-19's impact.

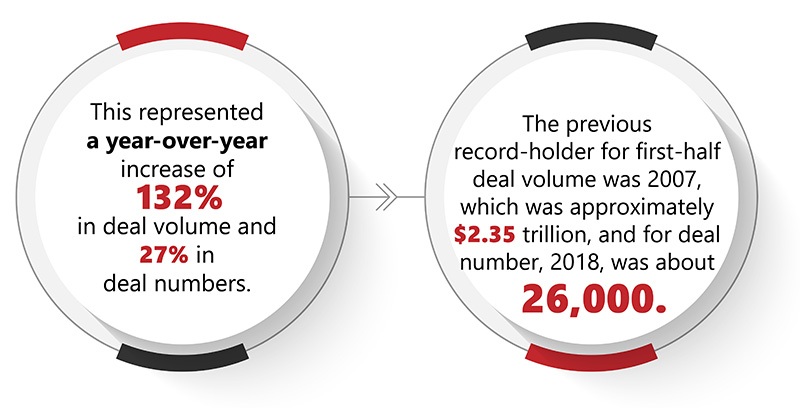

As many trends in combined to create the perfect surge, global deal making broke records during the first half of 2021. Deal volume reached $2.82 trillion between January & June end, with more than 28,000 deals announced (Source: Refinitiv).

In 2020, North America accounted for 46% of the global investment banking market. The Asia Pacific accounted for 26% of the global investment banking market. The smallest region of the global investment banking industry was Eastern Europe.

Investment Banks focused on mergers & acquisitions to increase their product range and market share. Boutique firms, which are small firms that specialize in a specific industry, were being acquired by large investment banking firms. The presence of many small firms focusing on niche markets offered significant opportunities for larger investment banking firms. This was driving the M&A activity in the investment banking industry.

All investment banks worldwide shifted towards business models that required less regulatory capital. For example, Barclays, Deutsche Bank, and Credit Suisse, three of the largest investment banks in the world, announced plans to shift from traditional underwriting to other activities, such as fundraising, mergers, and acquisitions advisory. This is partly because some investment banking activities are costlier than others. Although the regulations restricted the range of some banks and forced them to specialize, some investment bankers, such as JPMorgan and Citibank, continued offering a complete range of investment banking services.

This crisis saw the rise of leading IBs with greater organizational flexibility and agility, more digital-first business models, and simplified operations. Strategic investment was most likely directed by the most proactive companies that assessed their vulnerabilities. For example, IBs that focused on digital transformation strategies and improved their technology, data, and infrastructure were well-positioned to grow and profit in the new normal.

The investment banking industry has faced significant challenges due to recent economic shifts. As a result, banks will have to adapt their operations to meet the changing investment landscape.

COVID-19, changing financial regulations, market democracy, client sophistication, shift to remote work arrangements, and rapid technological advances are major challenges investment banks face. Banks can drive higher returns even with these challenges, but they must retool their business models and operational platforms.

There is a possibility of a split in the investment banking industry. A bifurcation of broker types, with "Flow players," those who specialize in the middle- and back-office functions, while "client capturers," who specialize in front-office functions. This will create an interconnected ecosystem with many players.

Their role in the bank's ecosystem depends on their capabilities and internal and external factors affecting the IB. Investment banks will also need to redesign their service delivery to fit a connected flow model. This means moving capacity and processes to the market providers. And optimizing the use of financial technology, data, and analytics to generate unique insight and added value.

Will investment banks be willing to think, rebuild and rely on other institutions to increase their future competitiveness? Some organizations may find it difficult, expensive, and time-consuming to disentangle their existing structures and develop and acquire digital technology to engage better customers and secure ecosystem partners (service providers). Still, the alternative is likely to reduce market competition and disintermediation.

Banks should "zoom out," visualize the future without immediate constraints, and then "zoom in" to translate this vision into prioritized initiatives. This framework can guide their journeys.

Investment banks need to develop a principled approach to strategic planning and delivery to overcome the obstacles.

i) Significant collaboration and cooperation are required in the near term for the possibility of an industry solution within such complex and nuanced local market structures.

ii) The individual role of market participants, incumbent service providers, utilities, and fintech is uncertain.

iii) Optimal operational and ownership structures of services provided within the ecosystem are uncertain.

iv) Ability to develop a convincing strategic business case with incremental benefit realization within the early years of investment.

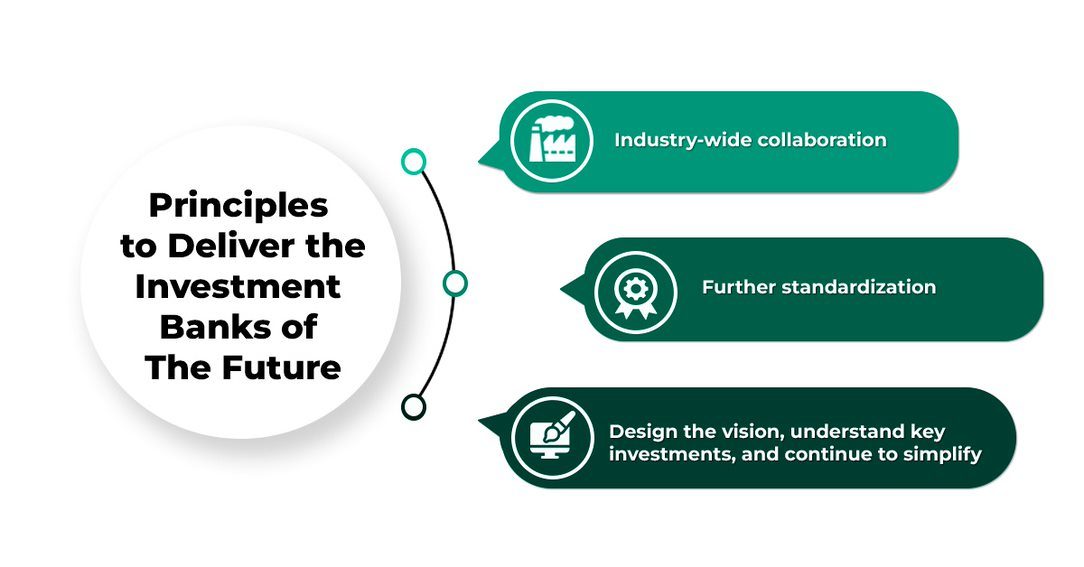

Investment banks must stick to three core principles to overcome these obstacles:

1) Industry-wide collaboration: Continue to work with market participants and collectively resolve industry problems. This includes forming further partnerships with fintech, utilities, and inumbent service providers.

2) Further standardization: An opportunity exists to create standards that support innovation and promote the adoption of new technologies.

3) Design the vision, understand key investments, and continue to simplify: Firms should continually invest in the journey to realize benefits on an ongoing basis and avoid an investment trap.

Here are a few examples of initiatives that can be used to start the journey:

Identify the utilities you need to outsource or create internal shared services functions across your bank (for data management, etc.).

Take into account the governance arrangements required to make a utility-based model successful.

Consider the impact of industry-led standardization on the ecosystem.

Consolidate operations activities and processes across asset classes (like single post-trade processing).

To increase flexibility and seamless connectivity, centralize data management and invest in application programming interfaces.

Consider using a cloud-based, scalable infrastructure to improve efficiency, reduce costs, and achieve faster time-to-market.

Discover the possible art with emerging technologies like AI, blockchain, advanced data analytics, and more.

Examine your workforce and workplace practices using a post-pandemic lens. Consider the shift from office-oriented, traditional employment to more flexible and technologically-enabled work environments.

Technology adoption in the investment banking sector has been slower than in other tech-savvy markets. However, unexpected changes and unmatched competition have prompted more banks to embrace digital transformation to drive smarter decisions, accelerate processes, and scale operations over the past two years.

The IB sector is benefiting from the sophisticated use of technology. Let's look at how technology has helped improve the investment banking industry.

More investment banks will adopt these tech-inspired direct-sourcing methods in 2022. They will also build business development teams and use supporting technology to speed up buy-side deals. Copper Run, one bank that has taken the technology sales route, is reaping the benefits.

Copper Run's analysts are responsible for sourcing deals that match the firm's buy-side clients' investment theses. Instead of manually sourcing deals, they invested in the most recent deal sourcing technology. This allows them to quickly identify non-transacted companies using data signals such as ownership type and employee count. As a result, they have increased their deal engagements by two folds.

2022 will see a shift in how investment banks use AI as more firms look to gain a competitive advantage by leveraging proprietary market insights. Frazier Miller, the COO of SourceScrub, stated that inspiration for these companies came from high-tech industries and firms that use machine learning and AI to drive algorithmic model development.

But, there is one caveat. It is easy to believe that AI-enabled technology will provide ground-breaking insights by feeding it as much data as possible. However, machines can't always tell if the data they receive is accurate and have a long way before making reliable and contextual decisions for humans. As a result, AI and machine learning in banks still rely on humans to provide quality data, place insights in context and make the best judgment.

Traditional deal processes start with a well-connected partner making informed decisions based upon past successes and educated guesses. This creates a clear chain of command. To ensure that each step is completed, other firm members use a waterfall approach once a plan has been set in motion. Analyzing and optimizing the plan is usually done after it has been implemented. After that point, it's too late to change priorities or alter the outcomes.

Instead, 2022 will see banks flourish in today's volatile and fast-paced market. This will be achieved by adopting an Agile approach to deal making. These firms will not follow top-down directives but use data to guide and plan their strategies. Each employee will be expected to be an expert in their job and use data to evaluate progress, priorities, plans, and progress. Teams will collaborate closely to respond quickly to new opportunities, spot threats early, and continually improve them in real-time.

Many of the world's largest banks, such as Goldman Sachs or BNY Mellon, are exploring how they can leverage bitcoin and other cryptocurrencies. While other people in the space speculate about how blockchain might disrupt the industry. One thing is certain: DeFi is still very young, so we don't know exactly how it will disrupt banking technology.

Banks can get ahead of DeFi in 2022 by building proprietary market intelligence. Leading firms hire data scientists to create data warehouses, combine data from multiple sources, and build models that reveal meaningful insights. The secret to winning business is accurate market predictions, precise scoring systems, and other proprietary resources.

Banking's future will be very different from today's. Banks will have to adapt to changing consumer expectations and emerging technologies. Using technology to drive smarter decisions, accelerate processes, and scale operations is a no-brainer, and leaders should not wait for it anymore. The more you wait - the more obsolete your processes are likely to be.