The financial world today is a fast-paced environment where risk is no longer something to be managed; risk is to be expected. AI risk management is becoming one of the primary options, rather than just a supplementary one, as institutions struggle with the complexity and real-time volatility of data ecosystems. Leaving behind traditional static models, this new paradigm utilizes predictive analytics and machine learning to enable advanced, proactive, and adaptive risk management. It is not evolution. It is a significant redefinition of how financial risk is conceptualized and managed.

Organizations will transition away from legacy systems, and adopting generative AI in the risk domain requires a multidimensional approach that involves creating specific use cases, implementing strict data governance and privacy policies, incorporating continuous bias and hallucination detection, establishing interoperable and secure infrastructure, and developing effective governance with human-in-the-loop controls.

Define specific use case goals: Start with particular workflows, such as claims automation or real-time risk alert, to determine ROI in the early stage. According to the CFO Signals survey prepared by Deloitte, 42% of companies are experimenting with Gen AI, with only 15% implementing it as part of their strategy. Matching technology to business must avoid scattering non-focused deployment and make sophisticated risk management goal-oriented.

Strengthen data integrity and protection: Data integrity and security should not be compromised. In 2023, the financial services sector experienced an average data breach cost of US$ 5.9 million. Deploy encryption (at rest and transit), anonymization, and centralized control, which are critical to AI risk management and adherence to regulations such as GDPR/CCPA and Basel III.

Embed AI into existing risk structures: Gen AI creates novel threats such as bias, hallucination, and adversarial inputs, so adjust the model validation, audit logs, and control inventories. Organizations such as GARP suggest customized pillars of governance that address monitoring, accountability, third-party oversight, and regulatory liaison.

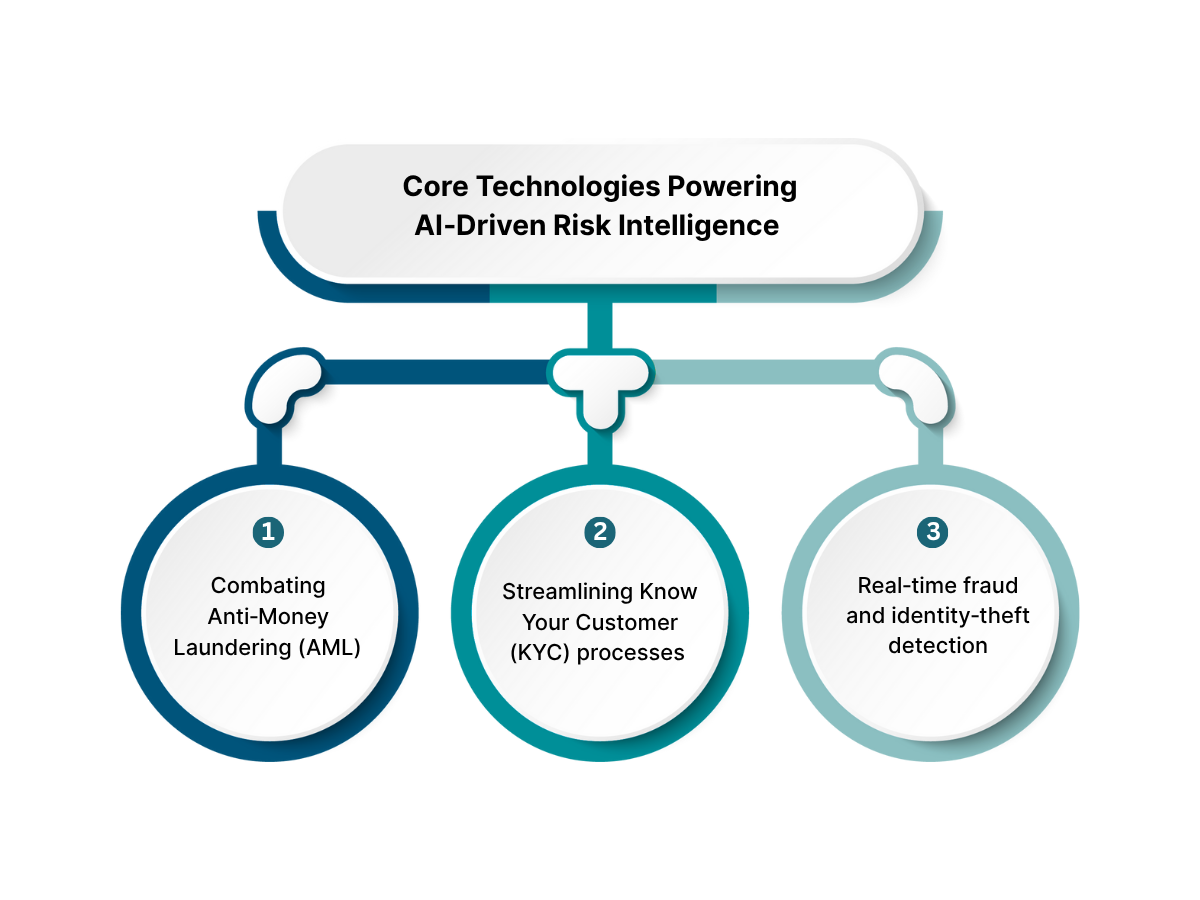

Modern AI risk management is based on a combination of advanced technologies that interact with each other to identify the emergence of new threats and protect financial systems. Let's look at the breakdown below:

In the constantly changing financial services environment, AI risk management has become an integral part of the process that facilitates operational effectiveness and asset protection. Financial institutions are also pursuing AI-based solutions that best suit their needs—particularly by developing industry-specific applications of AI in investment banking, rather than using generic solutions.

AI risk management is based on data, but its effectiveness relies on the quality and transparency of that data. Even the most advanced models fail without scrupulous governance, with research indicating that the cost of poor data to firms averages US$15 million per year.

The frameworks that the financial organizations are embracing focus on:

There is a corresponding model interpretability:

The new challenge facing financial services is how to make AI risk management frameworks fair, transparent, and subject to scrutiny. Artificial intelligence, particularly in lending, fraud detection, and trading, tends to be an opaque black box. They conceal their internal logic, and it is hard to spot system bias or appreciate automated choices.

Some of the most essential pressures and solutions are:

Global differences in regulations, encompassing everything from consumer protection to industry-specific regulations, make compliance very cumbersome and expensive. However, this regulatory pressure is essential; it forces financial institutions to transform their utilitarian black-box model into a high-end risk management framework that is transparent, fair, and robust.

Integrating AI risk management across all layers of data integrity, algorithm accountability, synergistic human-machine collaboration, and sector-focused strategies, financial institutions will be able to revolutionize their response agility and overall effectiveness. Lower the cost of compliance by 15% and reduce losses by up to 70% through AI-based anti-frauding systems. This transition cannot be optional- it must be necessary. The future requires a higher level of risk management based on AI, driven by openness, ethics, and human oversight.