In response to Covid-19, the investment banking industry has taken several actions such as adapting to the new contactless world, finding ways to engage with stakeholders, keeping their staff and customers safe, and becoming futuristic. IBCA discusses how the investment banking industry is hypervigilant and rewriting its business continuity plans.

High levels of uncertainty caused due to the coronavirus outbreak compelled the investment banking industry to shift to a sophisticated administration. The industry started revising its strategies, accelerating digital transformation, adding new services, outsourcing services, and taking measures for employee wellness.

Though there are ups and downs in overall business and strategies, the efforts to scale back business continue as the uncertainty remains elevated.

The industry witnessed a mixed curve of growth and backslide. Volatile markets contributed to increased trade volumes leading to a positive impact on revenue, while workplace disruption affected the normal functions.

Positive impact:

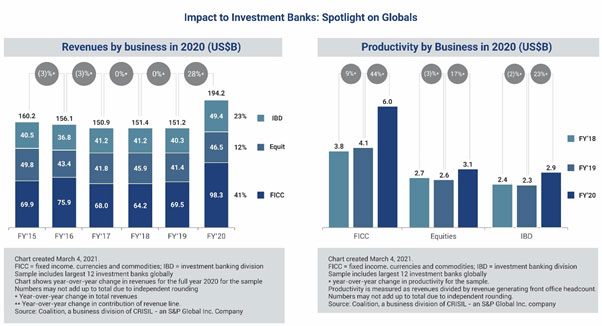

The total investment bank revenues at the 12 major U.S. and European institutions increased by 28 percent y-o-y to USD 194.2 billion in 2020, Coalition Greenwich's Investment Banking Index shows.

The 12 major banks include Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc., HSBC Holdings PLC, JPMorgan Chase & Co., Morgan Stanley, Deutsche Bank AG, Barclays PLC, BNP Paribas SA, Credit Suisse Group AG, Société Générale SA and UBS Group AG.

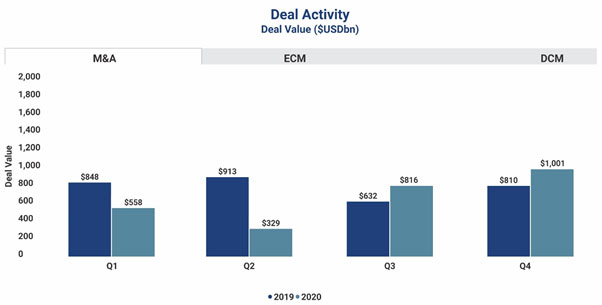

The global M&A deals value almost doubled in the H2 of 2020 to USD 1.736 trillion as compared to the H1 of the year, S&P Global Market Intelligence's latest M&A and equity offering reports.

Negative impact:

On the other hand, the challenges in conducting in-person engagements adversely affected the merger and due diligence process; prospecting the clients, and onboarding the clients which influenced the turnaround time and revenue prospects.

Also, workplace disruption affected the normal functions such as trade monitoring, processing key performance indicators (KPIs), KYC compliance, and review of anti-money laundering (AML). Indeed, remote work cultures demand vigilant processes and tools for trade and surveillance.

In summary,

Take a look at the industry’s main functions requiring changes.

Underwriting: Underwriting was indeed a profitable business until the technology companies exerted their influence by offering lower fees. The investment banks are now exploring IPO alternatives such as direct public offerings and alternative exchanges, while several banks are making deals with lower revenues.

Mergers and acquisitions: Again, an important sector of the bank has its sole power distributed now -between brokers and smaller companies. Online networks and SaaS tools enable brokers and smaller companies to transact affordably and swiftly. As a result, the bankers are now focusing on strategic mergers and acquisitions to build long-term businesses while expanding their portfolios.

Barclays, Deutsche Bank, and Credit Suisse plan to move to M&As and fundraising, leaving behind the traditional underwriting business with the hope to increase shareholdings in the market.

Technologies: As we see in every industry, emerging technologies like Artificial Intelligence, interactive platforms, virtual reality, and big data have influenced the banking industry to reinvent its business model through technology. The use of multiple trading platforms is becoming a must to stay in the race.

Revisiting business model: Several companies started processing their business methods, gaining clients, and tackling problems in their own way. As a result, the industry is losing its intermediary services (i.e., investment banking services), and is looking for other business models.

Above all these, the COVID-19 pandemic forced the industry to go remote and conduct virtual dealings. Some of the immediate steps the industry had to take include:

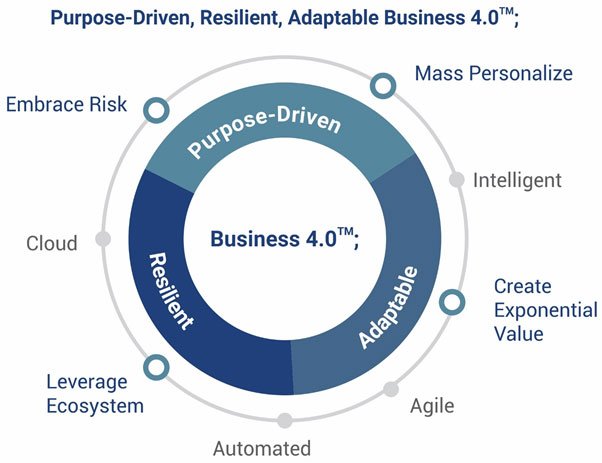

Investment banks must reframe their business models according to the COVID-realities. It includes increasing digital rigor and implementation of data-driven solutions, says, Parthasarathy and Karthik, Advisory Group of TCS Banking, Insurance, and Financial Services.

Further, they affirm that investment banking firms must strike a real balance between continuous transformation, growth, and sustainability. To emerge stronger from the crisis, the investment banks must:

Adopt touchless operations:

Implementation of end-to-end platform digitalization solutions such as digital client onboarding, preemptive exception management, Artificial Intelligence-powered solutions, and the use of machine learning solutions should be of high priority.

Offer a new beginning:

Launch offerings that caters to customers’ core purpose. It includes the implementation of a digital research desk, refinement of securities lending, and borrowing by using AI tools.

Infuse resilience into the infrastructure:

The banks must leverage partner ecosystems, improve customer experience, embrace cloud and digital technologies, implement shared investment models, and adopt insights-driven optimization. leverage partner ecosystems

Refining strategies based on the above-mentioned themes will help investment banks to withstand future shocks.

Source: TCS - Repositioning investment banking position: Driving growth post Covid -19

The recovery period may not be straightforward for all. Uneven recoveries will accelerate the need for active management and skilled investment banking professionals. Sustainability, climate change, and ESG are also the defining elements of the future.

Investment banks must adapt to new changes to win the new race brought about by COVID-19. Likewise, a career in investment banking during this period would be more challenging and inspiring too. Industries are looking forward to special talent who can show resilience in business, are updated with the new technology trends, and carve solutions for challenges.

If resilience is your forte, then you have splendid opportunities to thrive in the investment banking field. Earning an investment banking certification will help you to learn new things and hone your skills. Get certified to stay current and thrive continuously in the industry.