Today’s modern and complex financial environment demands strategic approaches to portfolio optimization.

Investors can improve their long-term returns by diversifying, balancing risk and return in a systematic way, and overcoming market volatility. The best investment portfolio optimization techniques offer an organized strategy to invest assets effectively, discover opportunities, and manage risk. This article discusses the practical ways and recent techniques that allow investors to get maximum returns without failure by having a well-organized portfolio and resilience.

The science of determining how individual assets should be combined to bring about maximum expected return at a specific risk level is called portfolio optimization. It is based on three fundamental concepts: risk vs. return, diversification, and correlation, that combine to form the way an optimized investment portfolio is constructed and run.

Let’s understand:

Investors make a tradeoff between potential returns and risks. The idea is the basis of portfolio optimization because a person cannot get more returns without taking more volatility.

Diversification of investments in assets reduces the volatility of a portfolio. One study of 2020-2024 reported average correlation coefficients of between 0.72 and 0.83 for diversified strategies and spikes of 0.85 to weaken the diversification benefits in stressful situations.

Buffering downside risk is by weak or negative correlations among assets. Portfolios with less average correlation have been demonstrated to work better than higher-correlation portfolios in Monte Carlo simulations (Impact of Correlation on Risky Portfolio Choice, 2025).

The modern portfolio optimization methods extend past the more traditional mean-variance models to a combination of more sophisticated strategies that enhance predictability and risk control. The most popular approach is the Black-Litterman model, which is based on the market equilibrium returns and modifies the results to incorporate investor preferences by a Bayesian model. The process can be used to decrease the extreme and unintuitive weights of assets that are characteristic of pure mean-variance models.

Recent research has improved Black-Litterman with machine learning models that create or optimize the input of the views. As an example, the addition of Long Short-Term Memory (LSTM) network forecasts as views in the structure have provided even superior performance compared to pure mean-variance benchmarks.

The other frontier is the implementation of transformer-GAN hybrid models with Black-Litterman to identify the complex, non-linear patterns in return dynamics. The method is able to provide more subtle predictive perspectives than standard linear models.

In the optimization of a portfolio, it is important to incorporate sound risk management practices so as to protect against downside risk whilst participating in the upside. These strategies not only limit risk but also fit the optimization process such that under stress, portfolios are resilient.

Beginning with Value at Risk (VaR) and Conditional Value at Risk (CVaR), these are commonly used as risk restrictions by optimization schemes. VaR is an estimate of the largest possible portfolio loss at a particular confidence level, yet it is not used to estimate the number of losses above that level. To address that gap, CVaR (also called expected shortfall) averages the tail risk of losses beyond VaR and hence became a more coherent risk measure.

A recent study in Indonesia’s banking sector found that using a Monte Carlo Control Variates approach reduced CVaR estimates at the 99% confidence interval from 2.569 percent to 2.084 percent, compared to standard Monte Carlo models, demonstrating how refined estimation can, in turn, sharpen risk control.

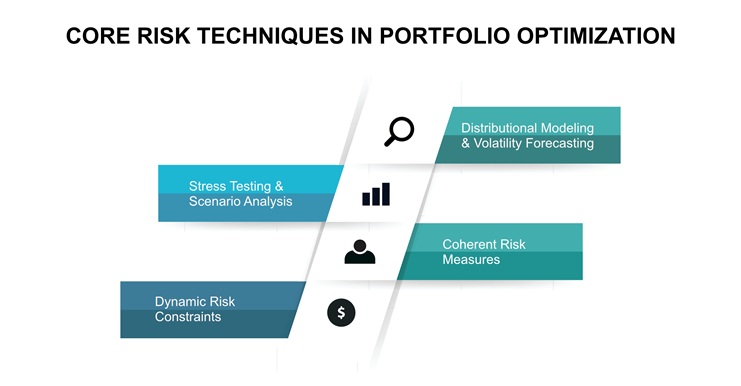

Key techniques and practices in risk management within portfolio optimization techniques include:

Stress test portfolio value under extreme market conditions (e.g., rate shock, geopolitical event, etc.). The more sophisticated techniques, the greater weight of recent similar regimes when developing stress situations.

Modify risk limits, as opposed to repairing them. An example would be to impose a CVaR ceiling that increases when volatility is high and softens when the markets are stable.

Use a model that captures fat tails, skewness, and clustering of volatility (e.g., GARCH-based mixtures). A study came up with VaR and CVaR using chi-square distributions in unison with GARCH predictions to enhance responsiveness when the market is volatile.

Apply risk measures that have coherence (monotonicity, subadditivity), such that diversification is appropriately rewarded in the optimization. CVaR is coherent, and VaR (only) can be sub additive.

Smart asset allocation and diversification are fundamental to the sound portfolio optimization method of balancing returns and risk.

Asset allocation determines the volume of capital invested in equities, bonds, real assets, and other alternatives. While diversification guarantees such allocations to be diversified in terms of sectors, geographies, and styles in a manner that mitigates the risk of concentration.

A few guiding principles:

Statistics show that, within the HSBC Affluent Investor Snapshot 2024, it was discovered that, on average, wealthy investors are holding four asset classes and 4.3 types of investment products, and most of them intend to diversify more within the next 12 months.

This trend highlights the fact that diversification is always a key focus of prudent investing. A diversified portfolio will provide good returns without too much volatility when the

best-performing asset class changes year after year, as is the case with a 20-year MFS analysis.

Implementing sound portfolio optimization methods is not as simple as using models. It involves aligning scenarios with long-term objectives, adjusting to market dynamics, and considering the risk-reward of opportunity situations. Integrating conventional and modern methods of investment portfolio optimization techniques will enable investors to leverage diversification, increase resiliency, and seek stable growth. As markets change, effective portfolio optimization requires constant review and readjustment, ensuring that portfolios are maintained in a position that maximizes their returns as the market evolves.