Impact investing stands at the forefront of a paradigm shift in the world of finance. It integrates social and environmental considerations into investment decisions. This burgeoning field represents a departure from traditional profit-maximizing strategies, prioritizing measurable positive outcomes alongside financial returns.

Research indicates a growing interest in impact investing among both individual and institutional investors. According to a survey conducted by the Global Impact Investing Network (GIIN), the global impact investing market reached USD 715 billion in assets under management in 2020. It is a substantial increase from previous years.

Furthermore, the same survey found that 88% of impact investors reported meeting or exceeding their financial expectations, dispelling the myth that impact investing necessitates sacrificing returns for social or environmental good.

In this article, we will go through the world of impact investing, exploring its principles, practices and potential for creating meaningful impact alongside financial gains.

What is Impact Investing?

At its core, impact investing is about aligning your investment decisions with your values. It is not just about making a difference! Instead of solely focusing on financial returns, impact investors seek to generate measurable and beneficial impacts on society and the environment.

Imagine investing in companies that are not only profitable but also actively working to address pressing global challenges, such as climate change, poverty or inequality. Impact investing is a part of sustainable financing. It empowers individuals and institutions to put their capital to work in ways that promote sustainability, social justice and long-term prosperity for all.

A key aspect of impact investing is the commitment to measuring and reporting on the social and environmental performance of investments. This emphasis on accountability ensures that impact investors can track the tangible effects of their capital allocation. This further facilitates transparency and informed decision-making.

It is important to note that impact investing is not a one-size-fits-all approach. It covers a diverse array of sectors and thematic areas, reflecting the varied priorities of investors. From renewable energy and affordable housing to healthcare and education, impact investing opportunities cover various industries. Each of these industries has the potential to address grave global challenges.

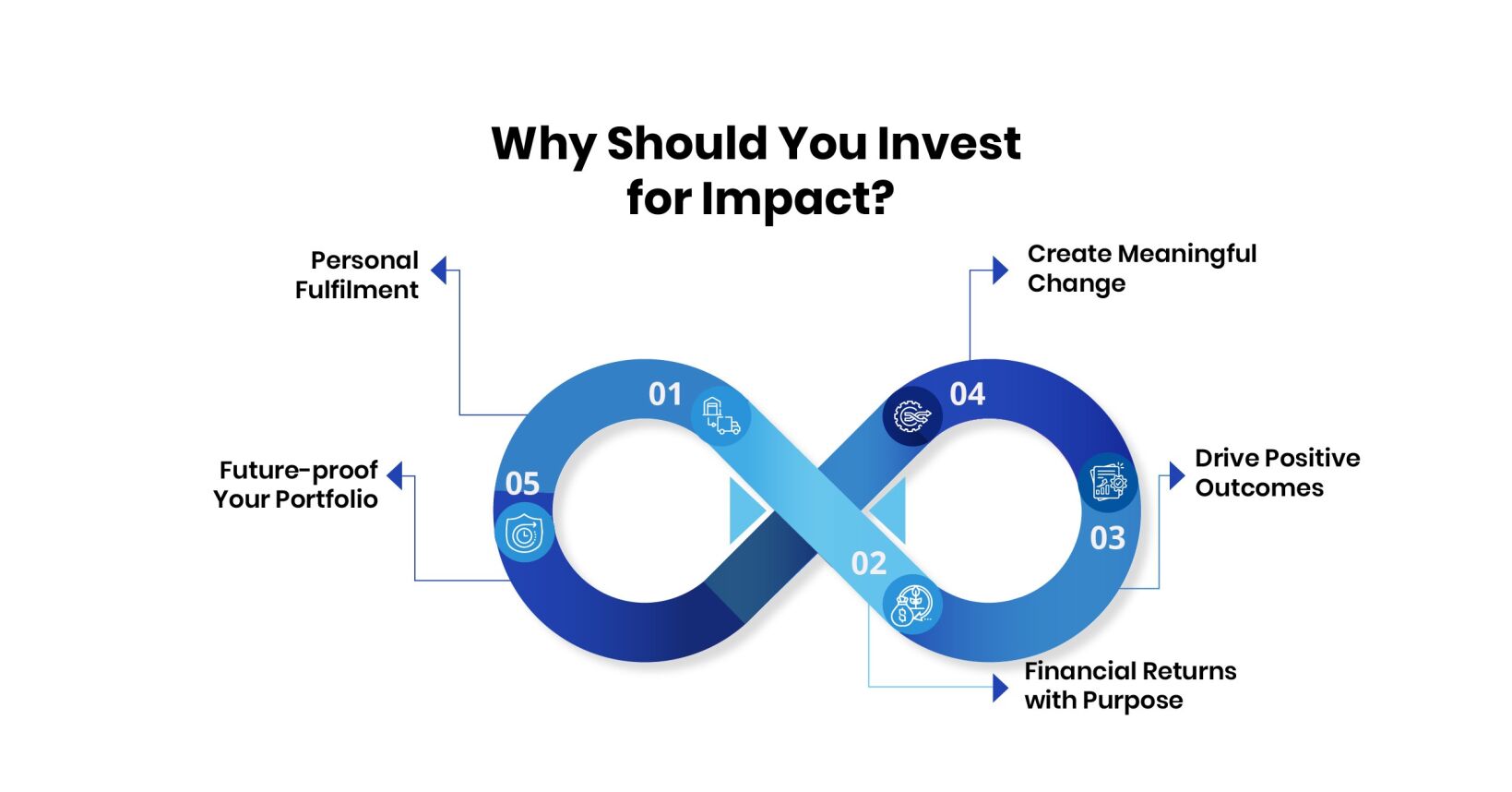

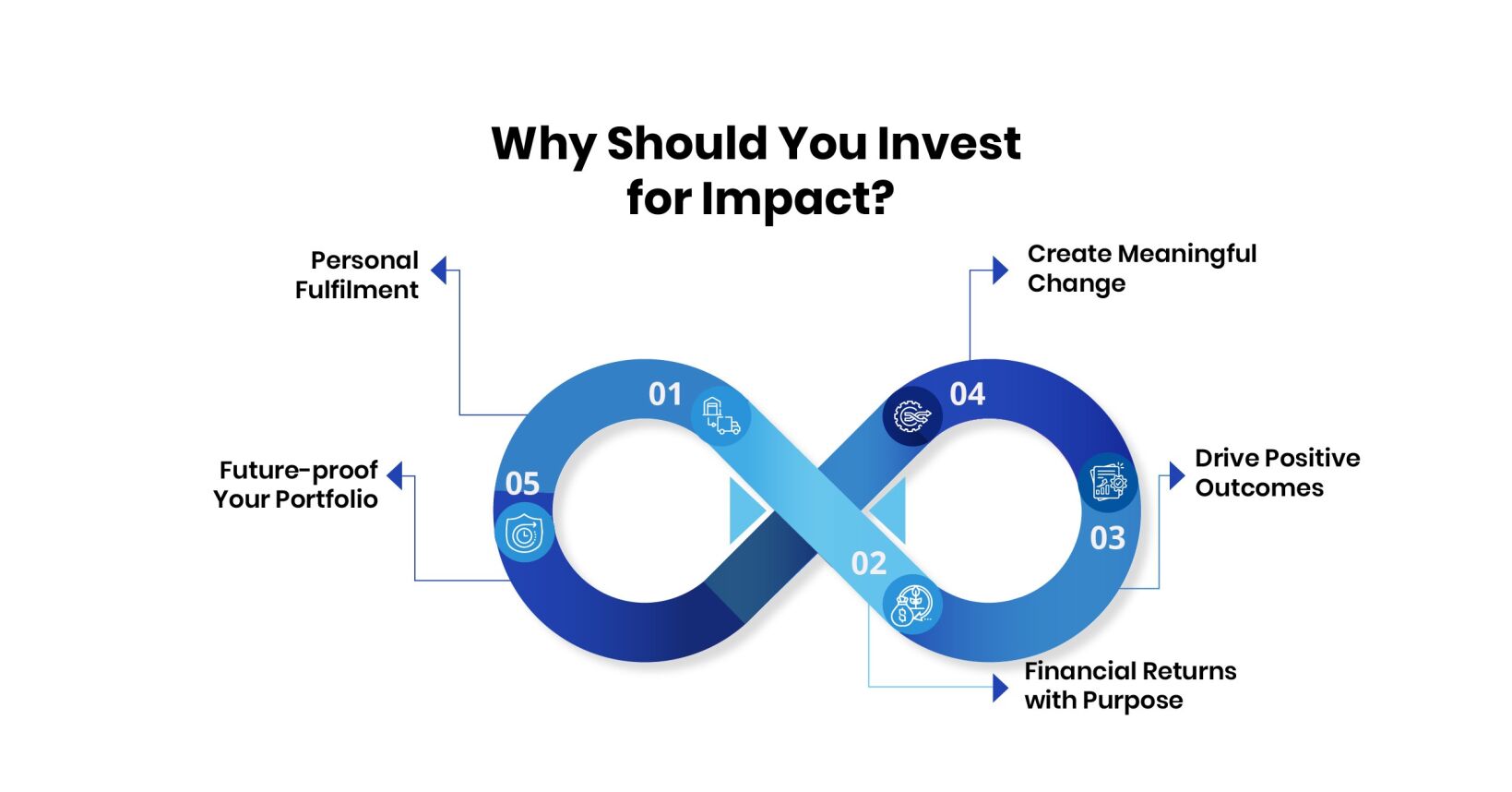

Why Should You Invest for Impact?

Investing for impact goes beyond merely seeking financial returns; it is about making a difference in the world around us.

-

Create Meaningful Change

Impact investing allows you to align your investments with your values and contribute to causes that matter to you. Whether it is supporting renewable energy, promoting social justice or fostering economic empowerment; your investments can make a tangible difference in addressing acute global challenges.

-

Drive Positive Outcomes

By directing capital towards companies and projects that prioritize social and environmental responsibility, impact investors play a pivotal role in driving positive outcomes. Whether it is reducing carbon emissions, improving healthcare access, or advancing education, your investments can catalyze meaningful change in communities worldwide.

-

Financial Returns with Purpose

Contrary to common misconceptions, impact investing offers the potential for competitive financial returns. Numerous studies have shown that companies with strong environmental, social and governance (ESG) practices tend to outperform their peers over the long term. By integrating sustainability into investment decisions, you can potentially achieve both financial prosperity and social impact.

-

Future-proof Your Portfolio

As societal awareness of environmental and social issues continues to grow, businesses that prioritize sustainability are likely to be more resilient and adaptable in the face of evolving market dynamics. By investing in companies with potent ESG practices, you can future-proof your portfolio against environmental risks, regulatory changes and shifting consumer preferences.

-

Personal Fulfilment

Beyond financial gains, impact investing can provide a sense of fulfilment and purpose. Knowing that your investments are contributing to positive change can bring a deeper sense of satisfaction and meaning to your financial journey. Whether it is supporting causes close to your heart or driving systemic change, impact investing offers a unique opportunity to align your wealth with your values.

Key Actors in the Impact Investing Landscape

Research into the impact investing ecosystem reveals a network of diverse actors driving positive change and shaping the landscape. An exploration of some key players and their roles is as follows:

-

Investors

According to a report by the Global Impact Investing Network (GIIN), individuals and institutional investors are pivotal in impact investing. The global market has reached USD 715 billion in assets under management in 2020. These investors allocate capital to businesses and projects aiming for financial returns alongside measurable social or environmental impact.

-

Entrepreneurs

Research from the Global Entrepreneurship Monitor (GEM) highlights the significance of entrepreneurs in impact investing. They drive innovation and lead impactful ventures. Such ventures address various global challenges such as climate change and inequality through sustainable startups and social enterprises.

-

Impact Investment Funds

Impact investment funds, as reported by the GIIN, play a crucial intermediary role. They pool capital from various investors and deploy it into projects aligned with specific impact objectives. These funds facilitate access to impact opportunities for investors while also providing support and expertise to investee companies.

-

Non-profits and NGOs

Studies show that nonprofit organizations and NGOs are integral to the impact investing ecosystem. Collaborating with investors and entrepreneurs, they leverage their expertise and networks to address social and environmental issues effectively. Research from the Stanford Social Innovation Review highlights the importance of partnerships between investors and nonprofit organizations in achieving meaningful impact.

-

Government Agencies

Government agencies can stimulate greater investment in sustainable and socially responsible enterprises. They can do it by fostering an enabling environment through policy frameworks, initiatives, regulation and incentives. According to a survey conducted by the Organization for Economics Co-operation and Development (OECD), governments worldwide are increasingly recognizing the potential of impact investing to address societal challenges.

-

Academic Institutions

Academic institutions contribute to impact investing through research and education. By advancing knowledge and fostering innovation, academic institutions play a vital role in driving the evolution of impact investing. According to the Journal of Sustainable Finance & Investment, they generate valuable insights, develop best practices, and train the next generation of impact leaders. By advancing knowledge and fostering innovation, academic institutions play a vital role in driving the evolution of impact investing.

-

Impact Measurement and Report Organizations

Impact measurement and reporting organizations provide essential tools and frameworks for evaluating the social and environmental performance of impact investments. The Impact Management Project has highlighted the growing demand for standardized impact metrics, enabling investors to assess and communicate the effectiveness of their impact strategies accurately.

Investing for Impact in Practice

-

Identifying Impact Areas and Goals

In the case of impact investing, it is important to find out the areas where you want to make an impact. This means aligning investments with your values and goals, whether it supports environmental protection, promotes education or increases economic empowerment. Take some time to think about what is most important to you and where you believe your investments will have the greatest impact.

Think about things that touch you personally and that you are passionate about. Perhaps you are concerned about climate change and want to invest in renewable energy projects. Or you are passionate about social justice and want to support initiatives that promote equality and diversity. By identifying your areas of influence, you can focus your efforts and resources where they matter most.

Once you've identified your impact areas, it's essential to set clear and measurable goals. What specific outcomes do you hope to achieve with your investments? Whether it's reducing carbon emissions, improving access to education, or empowering marginalized communities, setting goals will help guide your investment decisions and track your progress over time.

Keep in mind that impact investing aims to improve the world rather than just provide financial gains. You may accomplish both your financial goals and make a difference by determining your impact areas and meaningful goal-setting. Thus, before you embark on your impact investing journey, take some time to consider your beliefs, identify your impact areas, and set some ambitious but attainable goals.

-

Investment Strategies and Options

Research into impact investing reveals a plethora of strategies and options tailored to individual financial goals and values.

-

Direct Investments: According to a report by the Global Impact Investing Network (GIIN), direct investments remain a popular choice among impact investors, with 42% of respondents indicating a preference for this approach. Direct investments offer hands-on involvement and a tangible connection to impact projects, making them compelling options for those seeking direct engagement.

-

Impact Investment Funds: The GIIN report also highlights the prevalence of impact investment funds, with 72% of respondents reporting involvement in fund investments. These funds provide diversification and professional management. This further appeals to investors seeking exposure across various impact areas while benefiting from expert oversight.

-

Socially Responsible Mutual Funds: Research from Morningstar indicates a growing interest in socially responsible mutual funds, with assets under management in sustainable funds reaching USD 17.1 trillion globally in 2020. These funds offer exposure to companies meeting specific ESG criteria, catering to investors keen on aligning their investments with their values.

-

Community Development Finance Institutions (CDFIs): According to the Opportunity Finance Network, CDFIs have collectively invested over USD 222 billion in underserved communities in the United States. Investing in CDFIs enables individuals to directly support community development initiatives, addressing socioeconomic disparities and fostering economic empowerment.

-

Green Bonds: The Climate Bonds Initiative reports a surge in green bond issuance, reaching a record USD 305.3 billion in 2020. Green bonds finance environmentally friendly projects, attracting investors seeking to support climate action while earning fixed-income returns.

-

Social Impact Bonds: Research from the Brookings Institution highlights the potential of social impact bonds in addressing complex social challenges. With over 200 social impact bond projects launched globally, investors have the opportunity to finance social programs while potentially earning financial returns based on outcomes achieved.

-

Real Estate Impact Investing: The Global Impact Investing Network notes the growing interest in real estate impact investing, particularly in affordable housing and sustainable development projects. Real estate offers diverse opportunities for impact investors, with initiatives aimed at addressing housing affordability and promoting environmental sustainability.

-

Measuring and Managing Impact

Understanding the impact of your investments is crucial in the world of impact investing. Let’s explore some ways of measuring and managing this impact in a meaningful way.

-

Defining Impact Goals: Start by clearly defining your impact goals. What positive outcomes do you hope to achieve with your investments? Whether it's reducing carbon emissions, promoting gender equality, or improving access to education, having specific goals will guide your investment decisions.

-

Choosing Metrics: Once the goals are set, it is important to choose the right metrics to measure the impact. These metrics should be relevant to your goals and provide meaningful insight into the social and environmental impact of your investments.

-

Collecting Data: Data collection is the key to effective measurement of impact. This may include gathering information about investment companies, conducting surveys or interviews or using third-party sources. The goal is to collect reliable information that accurately reflects the impact of your investments.

-

Monitoring and Evaluation: Regular monitoring and evaluation are essential to track the progress of your investments and ensure you are delivering on your impacts. This may include ongoing data collection, performance reviews and stakeholder engagement to assess the effectiveness of your investment strategies.

-

Adjusting Strategies: Be prepared to adjust your investment strategies as needed based on your monitoring and evaluation activities. This may include reallocating resources, engaging with investors to improve performance, or exploring new opportunities that better align with your performance goals.

-

Transparency and Reporting: Finally, transparency and reporting are critical to impact investing. Be open about your impact goals, methods and results, and communicate your progress openly with stakeholders. This builds trust and accountability within the impact investing community.

The Future of Impact Investing

-

Trends and Innovation

In the ever-changing world of impact investing, staying informed about the latest trends and innovations is crucial.

-

Evolving ESG Integration: Environmental, Social, and Governance (ESG) factors continue to play a central role in investment decisions. More investors are integrating ESG criteria into their portfolios, signaling a shift towards sustainable and responsible investing practices.

-

Rise of Impact Measurement Tools: The focus on impact measurement is increasing and the development of impact measures and frameworks has increased. These tools help investors more effectively assess and communicate the social and environmental performance of their investments.

-

Focus on Diversity and Inclusion: The importance of diversity and inclusion in effective investing is increasingly recognized. Investors prefer investments in companies and initiatives that promote diversity in management, workforce and decision-making processes.

-

Tech-driven Solutions: Technology drives innovation into impactful investments that enable greater efficiency and scalability. From fintech platforms that facilitate impact investment deals to AI-powered impact assessment tools, technology is revolutionizing the way investors impact investing.

-

Impact Investing in Emerging Markets: Emerging markets are becoming hotbeds of impact investing, offering significant opportunities for positive social and environmental impact. Investors are increasingly looking outside traditional markets to allocate capital to high-impact projects in emerging regions.

-

Collaborative Partnerships: Collaboration plays a key role in increasing efficiency. Investors, governments, organizations and businesses are creating collaborative partnerships to more effectively respond to complex societal challenges and drive shared impact.

-

Policy and Regulatory Developments: Governments around the world are aware of investment opportunities to promote sustainable development. There is a growing trend towards policy and regulatory frameworks that support and encourage impact investment initiatives.

-

Challenges and Opportunities for Growth

Entering the world of impact investing presents a mix of challenges and opportunities.

Challenges-

-

Complexity of Impact Measurement: Measuring and quantifying the social and environmental impact of investments is a major challenge. Despite existing frameworks and tools, defining meaningful metrics and obtaining reliable data remains an obstacle.

-

Balancing Financial Returns and Impact: Striking a harmonious balance between financial performance and impact objectives is a delicate task. Some investors fear that emphasizing impact may jeopardize financial gain, while others want to achieve both.

-

Lack of Standardization: The lack of standardized impact measurement practices and reporting frameworks makes investment evaluation difficult. Without common metrics, comparing impacts is difficult for both investors and stakeholders.

-

Access to Quality Opportunities: Finding quality impact investment opportunities, especially those related to specific impact areas or geographies, is difficult. Identifying viable opportunities requires careful research and expertise.

-

Risk Management: Managing the risks associated with impact investing, whether financial, social or environmental, requires thorough due diligence and sound risk assessment and mitigation strategies.

Opportunities for Growth-

-

Increasing Investor Demand: The surging demand for impact investing reflects a growing desire among investors to effect positive social and environmental change while realizing financial returns.

-

Innovation in Impact Measurement: Ongoing advancements in impact measurement tools and methodologies enhance the ability to assess and communicate impact effectively. These innovations empower investors to make more informed decisions and track progress toward impact goals.

-

Collaborative Initiatives: Collaborative efforts among diverse stakeholders amplify the impact of investments and drive systemic change. Through joint endeavours, stakeholders can tackle complex societal challenges more effectively.

-

Policy Support and Incentives: Recognizing the pivotal role of impact investing in achieving sustainable development goals, governments and regulatory bodies are offering policy support and incentives. These measures foster an enabling environment for impact investing to flourish.

In conclusion, impact investing represents a powerful convergence of financial prosperity and positive social change. With growing investor interest and evolving frameworks, the field is poised for significant growth. Despite challenges, collaborative efforts and policy support offer promising opportunities for creating a sustainable and equitable future.