After a year filled with chaos, uncertainty, and confusion, the dawn of 2021 looks refreshingly normal for investment banks. 2021 could offer a welcoming return to normal with new colors. Let’s trust the recovery and take a look at the year ahead with us.

The COVID-19 pandemic triggered an unusual recession, where the economic downturn and rebound are sharp and short. A large part of the output lost got recovered in less than three months. Still, the H2 2021 will be an early phase of the economic cycle.

The speed by which the governments can suppress the pandemic recession determines the economic losers and winners of the year ahead. Moreover, the development of the vaccine and its distribution will help to accelerate the recovery phase. The question here is about the time needed to manufacture and distribute the vaccines, which may lead to an uneven pace of global recovery.

As the global economy continues to heal from the coronavirus pandemic, let’s see what the world’s top investment advisors say about 2021 here.

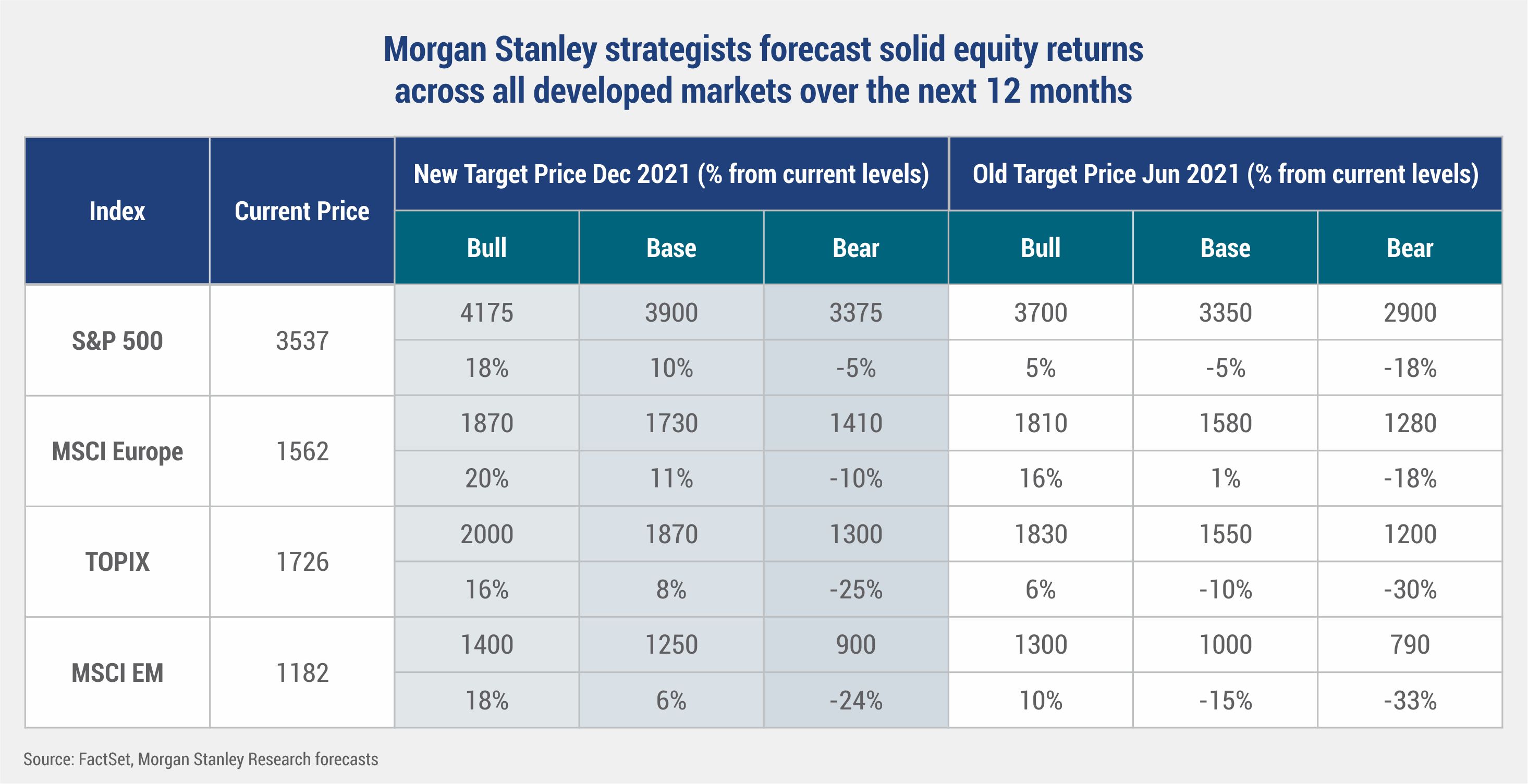

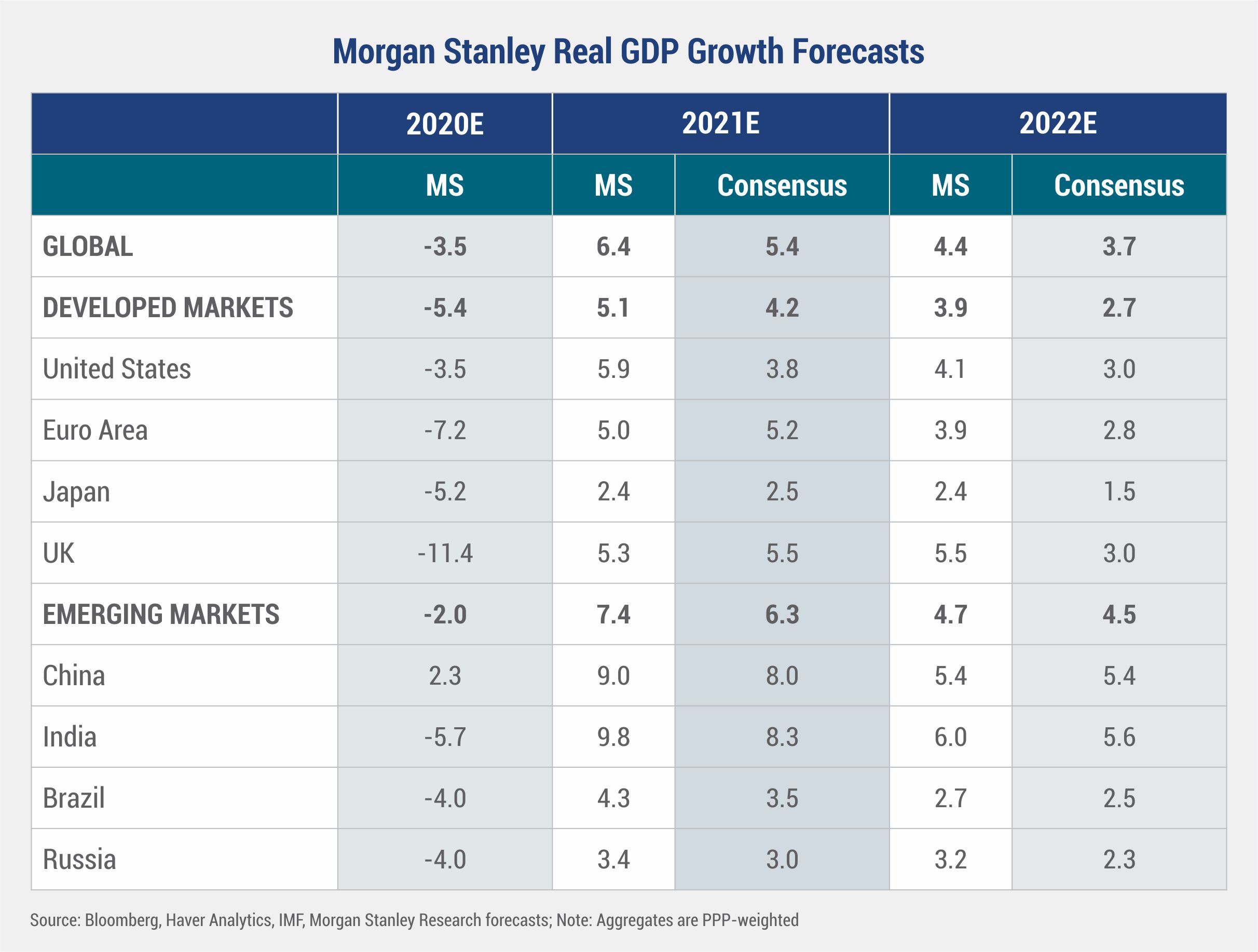

The economics team at Morgan Stanley Research says the V-shaped recovery enters a self-sustaining phase and will deliver 6.4% GDP growth this year. Morgan Stanley’s strategists expect 25% to 30% earnings growth across major equities markets across the regions, though there is the potential for double-digit returns in developed markets. Andrew, the Chief Cross-Asset Strategist says that though there are challenges, the global recovery will be sustainable, synchronous, and might get support by policies. 2021 will see an above-average risk-adjusted return in equities and credit.

The US economy was resilient through the pandemic. The consumer spending returned to near pre-COVID-19 levels and the average personal incomes in the US have surpassed pre-pandemic levels. Considering these and other factors, 5.9% GDP growth is projected in 2021.

In Europe, growth will resume as economies reopen. The team of Chetan Ahya, Morgan Stanley’s Chief Economist forecasts 5% GDP growth in 2021 and 3.9% in 2022. Likewise, Korea and Taiwan - the trade-dependent economies and India and Brazil – the domestic demand-oriented economies are exhibiting positive growth year-on-year. Further, Morgan Stanley projects that the China economy will expand by 9% in 2021 and by 5.4% in 2022.

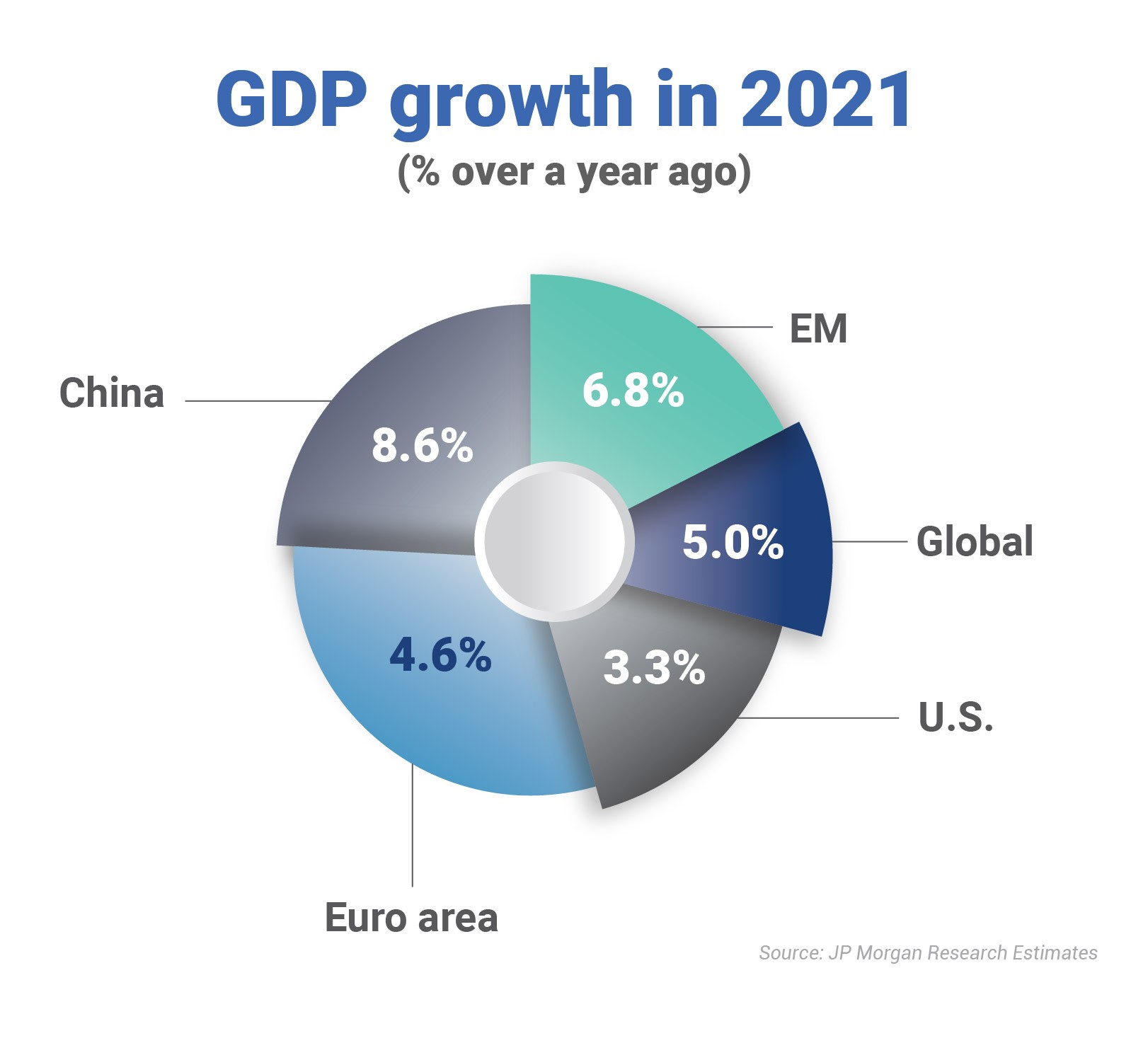

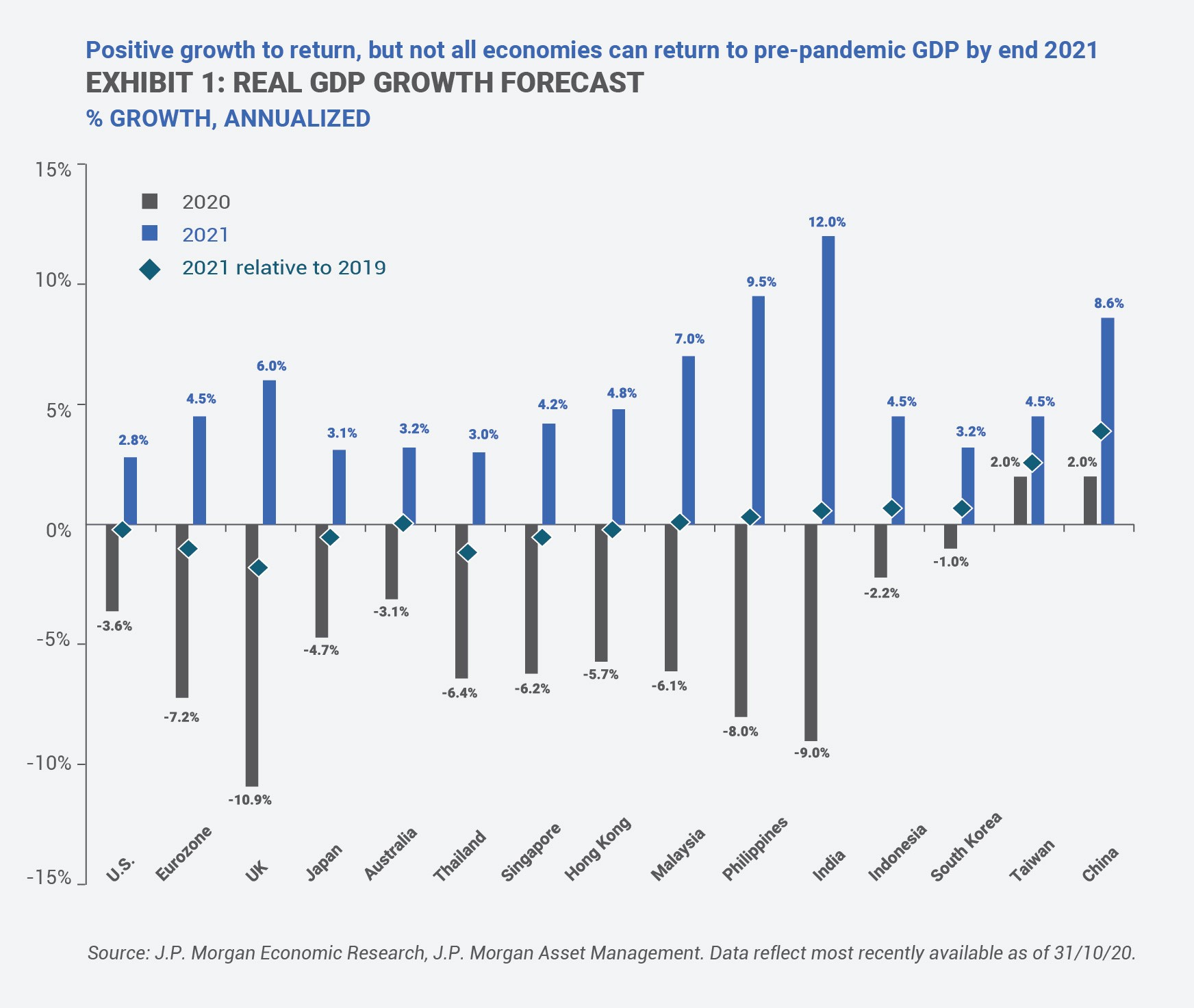

The global research analysts at JP Morgan believes that recovery, reflation, and rotation against the fiscal and monetary policies support will set the backdrop for key market and economic calls for 2021. We can witness the strongest global recovery of the decade by the end of 2021, once vaccine prospects get realized as expected, says Joyce Chang, Chair of Global Research.

China is returning gradually to normality, as reflected in its economic rebound since 2Q 2020, and will continue to lead the global economic recovery in 2021. The competency to manage the pandemic must combine with a rebound in the global trade cycle for a strong recovery in East Asian economies – Korea, Singapore, Hong Kong, and Taiwan.

In the US and Europe, governments should strike a balance between economic momentum and pandemic management for economic recovery. Fiscal and monetary policies should remain supportive in 2021 too.

2021 will be a year where the global economy will recover from the pandemic. Uneven recoveries would imply the need for more active management, investment banking professionals, portfolio companies, rigorous technology adoption. Also, the investors should get ready for re-balance by reviewing their portfolios regularly and renewing their commitment to investment principles.

Share your hopes for 2021.