Introduction

Finance is entering an era where intelligence is computational, not human. Large language models are reshaping how banks, analysts, and investors process information. In short, Finance industry is moving beyond automation to strategic interpretation. By integrating data, context, and sentiment, these models turn complex reports into actionable insights. Their impact isn’t theoretical anymore; it’s shaping how institutions think, respond, and compete in an increasingly data-driven financial ecosystem, and compete in a data-driven financial ecosystem.

Inside the Structure of Financial-Grade LLMs

Banking has distinct requirements and a rigor that general-purpose AI tools cannot support. Unlike wider applications, an LLM in finance should be of a high standard in terms of data integrity, regulatory compliance, and subject understanding.

-

Data complexity and specificity in the financial sector: In the financial industry, models are based on both structured information (balance sheets and transaction history) and unstructured information (earnings-call transcripts and regulatory filings). The European Securities and Markets Authority report Leveraging Large Language Models in Finance indicated that 85% of the surveyed organizations already used LLMs, but less than 20% used fully customized models, reflecting the difficulty in incorporating specialized datasets.

-

Regulatory and audit readiness: Finance-grade models, unlike consumer applications, need to be able to produce explainable output and preserve detailed logs, and help in audit trails. They are required to meet internal risk frameworks and supervisory guidelines, besides optimizing fluency.

-

Precision under uncertainty: The study "Evaluating Large Language Models in Financial NLP" identifies that the use of LLMs in the financial sector is not based on their language ability alone but on their expert-level performance of financial disclosures.

Core Use Cases Reshaping Financial Operations

The growing use of bold applications of LLM to finance, where large, context-sensitive models are not merely experiments, is also one of the most significant changes in the industry. For example:

-

Credit and risk analysis: Financial institutions now use LLM in banking and finance to analyze large amounts of data on borrowers, process creditworthiness on both structured and unstructured data, and produce more detailed risk development profiles in real time.

-

Market trend analysis and financial forecasting: Large language models in finance models have been used in the trading and asset management business to read market commentary, earnings transcripts, regulatory filings, and social signals that give traders better scenario modelling and quicker creation of insight. As an example, a study approximates that in 2025, almost half of the digital processes in financial institutions will have been automated by the use of massive models.

-

Document and data ingestion at scale: A specialized 2025 paper demonstrated how the universal metadata generation approach with LLM has a dramatic positive impact on asset-backed securities and other complex instrument processing, allowing for the identification of risks much faster and the finding of information more efficiently.

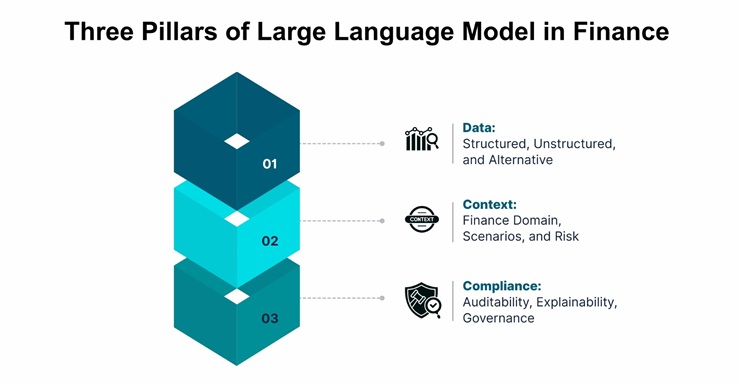

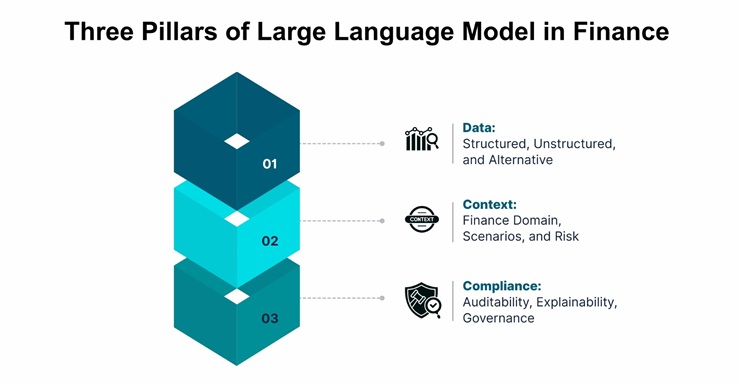

Building Financial-Grade Models: Data, Context, and Compliance

In high-stakes finance, building a model that meets the demands of precision, transparency, and regulatory compliance is critical. Implementing a large language model in finance requires embedding it in three pillars that are closely connected, including data quality, domain context, and compliance controls.

Data: Structured, Unstructured, and Alternative

-

Three-quarters of financial institutions currently involve AI in their modeling systems; an indication of the way data ingestion and processing have integrated to be central to performance.

-

The shift to alternative data (including web traffic and sentiment) is currently occurring, as around 72% of analysts seek to supplement forecasts with alternative data.

Context: Finance Domain, Scenarios, and Risk

-

Financial models are predicted to be scenario-oriented and real-time to represent the 2025 environment of sudden market changes and regulatory shocks.

-

The financial modeling and valuation services market can be projected to expand at a 7.3% CAGR between 2025 and 2032, which reflects the need to have context-rich modelling frameworks.

Compliance: Auditability, Explainability, Governance

-

The pressures of regulatory and auditing require models that have version control, traceability, and clarity of decision logic, particularly when tools that are powered by AI are used.

-

The design of governance structures should be based on model risk, data provenance, and tracking, especially in cases involving an LLM of finance performing financial tasks such as credit rating or trade.

Human-AI Collaboration: Redefining Roles in Banking

When it comes to the financial industry, cooperation between humans and AI does not imply the replacement of people, rather the change of their roles. In the research "Human-AI Collaboration in Financial Services," the results indicate that organizations that combine human control with AI systems gain about 34% in operating efficiency and save about 29% in decision-making time.

How Roles Are Changing

-

Data collection and processing are being replaced by data interpretation through AI recommendations, and domain knowledge and judgment are needed where machines have not managed to get as far. They are no longer involved in processing raw data but spend more hours refining recommendations and interacting with clients.

-

Human specialists will not need to examine all the transactions by hand; instead, they pay attention to exceptions identified by the systems, which will enable them to manage their work considerably more effectively and enhance control. This helps financial teams to react more quickly and focus on high-impact cases.

- Risk managers and compliance officers are becoming involved in the design, supervision, and auditing of AI models instead of approving decisions manually on a case-by-case basis. They make AI output in accordance with the regulatory norms and ethical conduct of the firm.

Practical collaboration in action

-

Clear Interfaces: It is possible to embed confidence scores and explanation layers, enabling human users to comprehend system recommendations and take appropriate action. Open work processes create trust and enhance decision-making.

-

Workforce Development: Retraining current employees to operate with AI products, not only to use them but also to retain human skills involved in the decision loop. Upskilling aids professionals in transitioning to strategic, judgment-focused jobs.

- Process Redesign: Most successful companies do not add AI to existing processes, but redesign jobs to have human beings handle strategic judgment and machines handle scale so that human-in-the-loop models can yield all their potential.

Emerging Innovations and Integrations

Key developments include:

-

Retrieval-Augmented Generation (RAG) in finance: Proprietary databases and real-time financial data have the potential to make firms generate contextually correct insights without only utilizing pre-trained knowledge.

-

Multimodal Financial Foundation Models (MFFMs): This type of model takes input not just text but also charts and tables and financial visuals, allowing more detailed analysis and reporting.

-

Hybrid retrieval-agent systems: Retrieval-based systems can be used alongside agentic reasoning to enable LLMs to solve more complex tasks like scenario simulation systems, automated report writing, and risk assessment advice.

Such developments are reworking the capabilities of LLMs in the field of finance. Multimodal information, adaptive retrieval, and specialized reasoning will allow financial institutions to perform more comprehensive analysis of their portfolios, simplify compliance processes, and provide more useful insights to decision makers.

Conclusion

The effect of the development of LLMs in banking and finance on decision-making, efficiency, and personalized services will increase as the field continues to progress. Companies that integrate these models with human wisdom are in a better position to innovate responsibly so that the insights are correct, practical, and legal. The future will be in favor of institutions that would incorporate large language models in finance in a deliberate manner, juggling between technological potentiality and practicality to transform financial intelligence in the industry.