Most corporate name changes are the result of mergers and acquisitions. But these tend to be unimaginative.

-James Surowiecki

The words Mergers and Acquisitions (M&A) are the consolidation of organizations or their massive business assets via financial transactions among the organizations. An organization might purchase and absorb another organization, merge with it to make the latest one, get some or all its assets, take a tender offer for its stock, or stage a hostile takeover.

It is also a USD 3 trillion activity that transforms the long-term trajectory of several individuals' careers, many enterprises, and various other industries. M&A also undergoes a few corporate jobs like joint ventures and management buy-outs. Many business owners and investment bankers choose the process of M&A because it is considered the simplest way for the two companies to combine in some form.

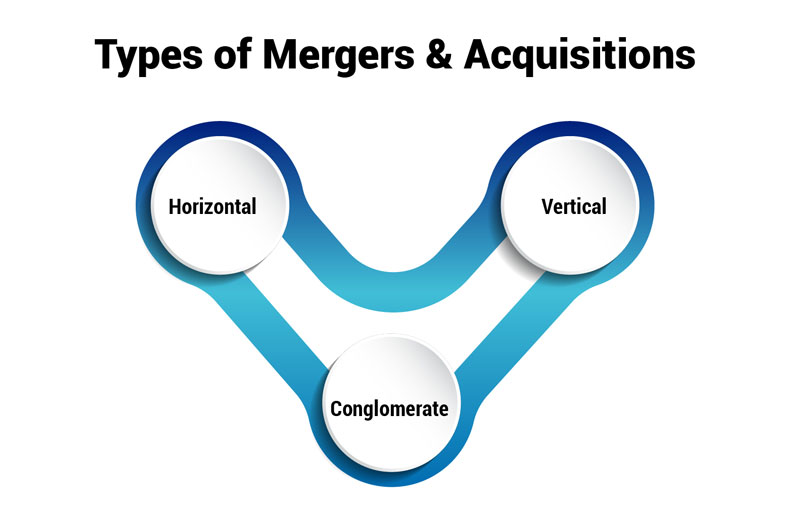

M&A transactions are usually present in several various forms, each possessing its own characteristics and implications.

Horizontal

This consists of consolidation or procurement of organizations working in a similar industry or market fragment. This methodology means to increase a piece of the pie, erase contests, and influence collaborations between comparable organizations. It empowers organizations to fortify their situation in the business and accomplish cost efficiencies through shared assets and activities.

Vertical

This takes place when an organization gains or converges with a provider of clients associated with the creation or dissemination chain. This methodology permits associations to control the whole worth chain, accomplish cost reserve funds, further develop store network effectiveness, and improve command over basic data sources or dissemination channels.

Conglomerate

Aggregate M&A includes the mix of organizations working in irrelevant enterprises or markets. This system empowers broadening and lessening risk by spreading ventures across different areas. It offers the possibility to use collaborations across various specialty units and permits organizations to enter new business sectors outside their center capabilities.

Mergers are structured in various forms, depending on the relationship between the two entities that are in a deal. An individual who wants to pursue the investment banking careers must understand these:

Market Extension Merger

In this, the structuring happens between two entities that are present and operate in the same market but do not overlap in their products or services combined. Here, the main objective is a vaster customer base and expanding globally.

Product Extension Merger

In this, the structuring involves organizations that operate in the same market and sell similar but non-competing products or services. The goal here is to cross-sell products to each other's customer base.

Congeneric Merger

In this, the structuring happens between organizations that are at equal levels in the general industry but with various products or services. The objective here is to leverage complementary skills or technologies.

The Mergers and Acquisitions (M&A) deal can be achieved with the help of using many structures. These are the following terms used to categorize the structure of M&A deal:

Conglomeration

Conglomeration is termed as a merger between entities when there is no business overlap. It means that they do not perform their operations in a common business area.

Friendly Acquisition

In this the targeted organization’s management and board of directors will be present in an agreement with the acquisition. Negotiations are usually amicable, and the deal proceeds with mutual consent.

Hostile Takeover

This occurs when the acquiring organization creates a bid to buy the targeted organization without getting the approval of its board or management. This typically involves a direct approach to the targeted organization’s shareholders to acquire control.

There are too many real-time examples of M&A deals. A few of them were announced and are in progress, and many are completed. Knowledge of these will be useful to crack an investment banking interview.

Qualcomm's Acquisition of Nuvia

Qualcomm announced that it is planning to acquire Nuvia - a semiconductor firm, which specializes in high-performance processors. The deal is focused on strengthening Qualcomm's technology and chip development capabilities.

Verizon's Acquisition of TracFon

Verizon Communications has successfully taken over TracFone Wireless - a prepaid and value-focused mobile operator, in a deal valued at approximately USD 6.9 billion. This acquisition occurred to expand Verizon's presence in the prepaid wireless market.

The entities that are involved in an M&A deal will value the targeted organization differently. The seller usually values the organization at the highest price available, whereas the buyer usually attempts to purchase it for the lowest price possible.

Discounted Cash Flow (DCF) Analysis

Estimation is done for the current value of the targeted organization’s future cash flows, incorporating aspects such as projected revenue growth, operating expenses, capital expenditures, and the discount rate.

Asset Valuation

Assess the target's tangible and intangible assets, such as real estate, equipment, intellectual property, and brand value. The value of these assets can contribute to the overall valuation.

The M&A activity occurs when the shareholders of the acquiring organization witness a temporary downfall in share value and might also experience favorable long-term business performance and dividend, dilution of voting power and ownership due to the more amount of shares, and loss of control.

Detailed planning and execution are crucial for M&A success. Evaluating and incorporating business culture and vision, including employee well-being, provides a cohesive organization. M&A offers transformative opportunities when approached with care and a people-centred emphasis.