The investment banking career path can be likened to a fraternity house, complete with a structured hierarchy, specific rites of passage, and associated perks and added responsibilities at each tier. The investment banking analyst has a dynamic role that demands a unique blend of analytical prowess, financial acumen, and resilience. In this comprehensive guide, we'll delve into the nuances of investment banking analyst jobs, covering everything from qualifications to growth opportunities.

Investment banking analysts play a crucial role as intermediaries connecting businesses in need of funding with investors seeking lucrative opportunities. Employing various strategies, they strive to cultivate financial success for both the company seeking capital and the investors eager to explore promising ventures. Serving as a linchpin in the investment banking ecosystem, they work on a variety of financial transactions, such as mergers and acquisitions, capital raising, and restructuring.

The journey begins with education. Most Investment Banking Analysts hold a bachelor's degree in finance, economics, or a related field. While one's major doesn't rigidly dictate their career, individuals pursuing this path often hold degrees in finance, business, math, or economics. The flexibility of the career allows professionals from diverse academic backgrounds to enter the field successfully.

These varied academic foundations collectively enrich the skill set required for success in investment banking career path, emphasizing that a broad spectrum of educational backgrounds can lead to a fulfilling journey in investment banking analyst jobs, highlighting the adaptability and inclusivity of this profession.

However, the field is highly competitive, and many analysts choose to bolster their qualifications with advanced degrees like an MBA. Academic excellence is often a prerequisite, but interpersonal skills, dedication, and a genuine passion for finance are equally vital.

The daily grind of an investment banking analyst is not for the faint of heart. As a multifaceted financial professional, the role involves conducting comprehensive valuation analyses, encompassing discounted cash flows, relative valuations, asset valuations, comparable company analysis, and precedent transaction analysis. These professionals navigate spreadsheets and financial models, conduct market research, and prepare pitch books and presentations for client meetings. The role is demanding, often requiring long hours, attention to detail, and the ability to thrive under pressure.

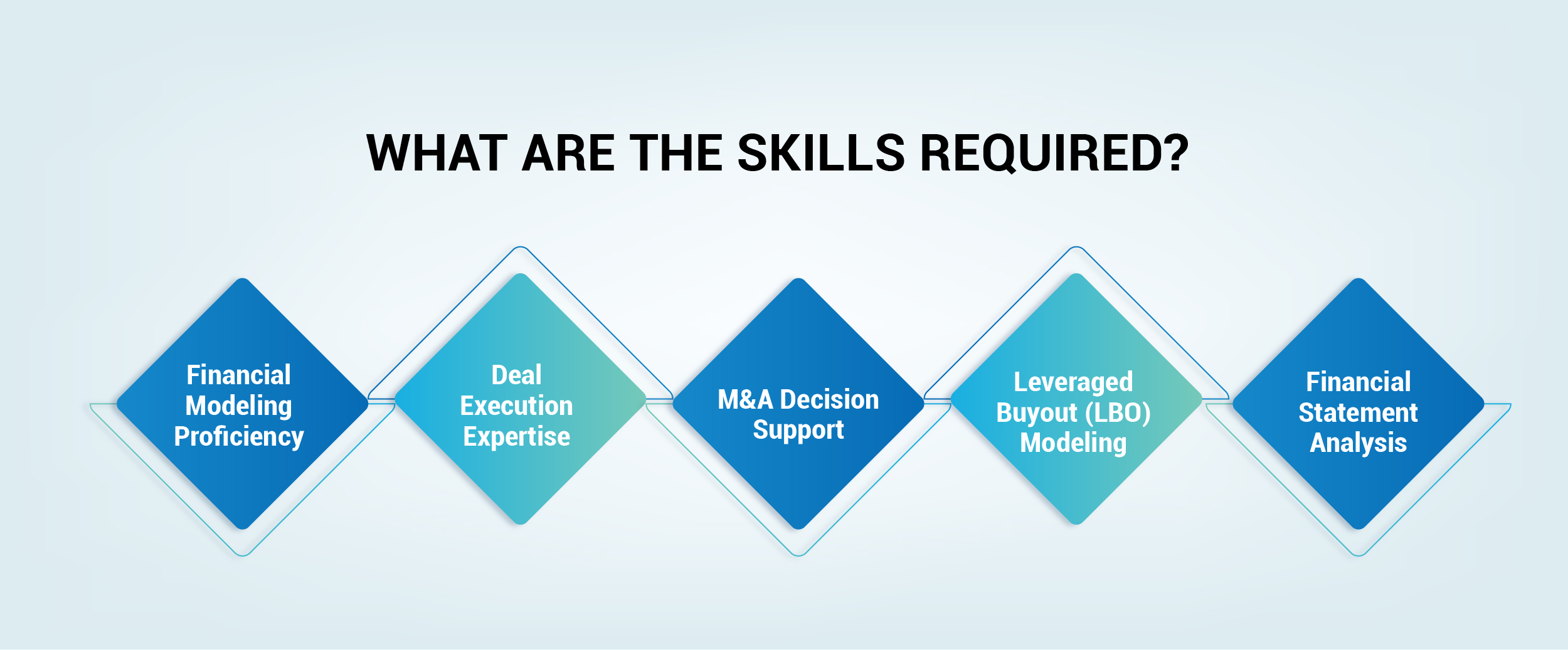

Success in this role hinges on a diverse skill set. Investment Banking Analysts need to have strong analytical skills, effective communication, and attention to detail. These skills are absolutely non-negotiable. Investment banking analyst jobs require a dynamic blend of skills crucial for navigating the intricate world of finance.

Adaptability is key in this job sector, as analysts often find themselves working on diverse projects with cross-functional teams as pivotal players in executing successful deals and delivering impactful solutions to clients.

Although the investment banking analyst jobs offer a considerable amount, new grads have to fight and grind a while in the competitive market to receive the big bills. While the entry-level job reports a median annual salary of $81,000, the real allure comes later with a huge potential of substantial bonuses and benefits. According to Glassdoor, the median annual salary in the United States is reported at $176,579 per year, with considerable variation influenced by factors such as company, industry, location, and experience.

Within the banking industry, the average salary stands at $157,000 per year. However, when considering the comprehensive "all-in" compensation for most 1st-year analysts in investment banking, it typically falls within the range of $170,000 to $190,000 annually. These figures underscore the lucrative nature of the field and the potential for competitive remuneration based on various influencing factors. Typically, bonuses for Investment Banking Analysts range from 0.5x to 1.0x of their base salary. It's noteworthy that compensation outside the U.S., even in financial hubs like London, tends to be lower.

The Investment Banking Analyst role is not dead-end; it's a steppingstone to a promising career. Successful analysts often climb the corporate ladder, moving on to roles with more responsibilities such as Associate and advancing further, the next is the Vice President (VP). At the zenith of the hierarchy is the Managing Director (MD), reflecting the pinnacle of achievement in this dynamic industry.