In corporate finance, mergers are not assessed on strategic fit only, but also on financial impact that can be measured. Accretion/dilution analysis is one of the most popular decision tools to measure this, a technique that analyzes the ability of a deal to recast the earnings per share of the acquiring company. Decision makers can use the accretion dilution model to determine whether shareholders will benefit or be subject to dilution, and it is a key step in responsible merger modelling.

The accretion dilution model predicts the effect of a merger or acquisition on the acquiring firm in terms of earnings per share (EPS). It evaluates the presence of immediate gains to shareholders or a decline in EPS after closing. Some of the important aspects in the model are:

According to a recent Deloitte 2025 survey, 88 percent of the corporate respondents have changed their deal-targeting approaches within the last two years, and this is how dynamic financing assumptions and synergy projections are included in the accretion dilution model. In addition, more than half of CFOs in North America forecast their growth will be 1-10 percent of their growth in the next three years through M&A activity, which explains the significant importance of sensitivity testing, financing, and synergy scenarios.

Accretion/dilution analysis is central to determining the formulation of M&A decisions since it provides a clear and quantifiable estimate of the impact that the proposed merger will have on the earnings per share (EPS) of the acquirer. It assists boards, analysts, and investors in knowing whether shareholders are likely to be beneficiaries or victims of the deal before its closure. A study by G. Andrade revealved, 224 large acquisition deals and concluded that in the case when a deal is predicted to deliver EPS accretion, the announcement and long-term stock returns are positively affected, but not significantly.

Key impacts include:

In modeling how a merger will affect an acquirer’s earnings per share, several inputs must be precisely defined to make the accretion/dilution model reliable. The most important elements you need to include will be listed below, and the reason why:

1. Purchase consideration & deal structure

2. Cost of financing

3. Expected synergies and integration costs

4. Tax implications and accounting adjustments.

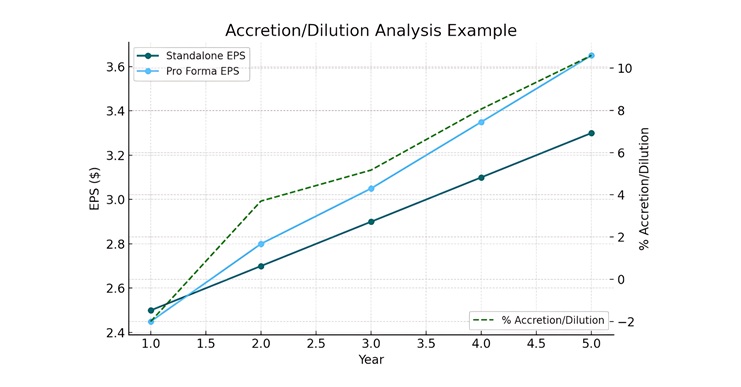

Illustrative Example:

| Year | EPS (Standalone) | EPS (Pro Forma) | Accretion/(Dilution) |

|---|---|---|---|

| 1 | US$2.50 | US$2.45 | (2.0%) Dilutive |

| 2 | US$2.70 | US$2.80 | +3.7% Accretive |

| 3 | US$2.90 | US$3.05 | +5.2% Accretive |

When you do an accretion/dilution analysis in merger modelling, the result of the accretive or dilutive effect of EPS on many stakeholders including investors, management, and boards will be important. Some of the ways to interpret what those outcomes mean, what to monitor, and the impacts on decisions are provided below.

What “Accretive” and “Dilutive” Really Mean

How Outcomes Influence Value and Decision-Making

| Factor | What Accretive Outcome Signals | What Dilutive Outcome Signals |

|---|---|---|

| Investor Confidence | Gains trust, may drive stock price up at announcement | Risk of negative reaction; may signal overpayment or poor deal structure |

| Valuation Multiples | Helps maintain or improve P/E; acquirer rarely trades down | May compress P/E and lower relative valuation if the market distrusts assumptions |

| Strategic Acceptance | Often seen as proof of good deal structuring and synergy realization | Needs stronger justification, perhaps long-term growth, market entry, or tech access |

When Dilution Can Be Acceptable

One of the parts of the story is the results of an accretion/dilution analysis. Short-term EPS dilution is often embraced by businesses to bring long-term strategic effects:

According to the Bain and Company 2025 Global M&A Report, global deal value increased 15 percent in 2024 to approximately US$3.5 trillion, with corporate M&A increasing 12 percent in a year. These values indicate how companies are undertaking trade-offs that favor deals that are more likely to dilute EPS in the short term but, in the long term, seek scale, global presence, and revenue synergies. In selecting strategy over optics, boards will be able to focus on long-term shareholder value and not short-term EPS benefits.

A solid accretion/dilution analysis does not merely provide an EPS check, but it also arises for shareholders who will gain or will lose in an M&A, and also provides the answer to whether the structure, costs, and assumptions of the deal actually brought about value creation. The accretion dilution model will be at the focal point in this, as it assists the decision-makers to make trade-offs between the short-term financial effect and the long-term strategic benefits. Ultimately, merger modelling is most effective when one lens of accretion/dilution is not the sole determiner of the success of a deal.