In this article:

Business entities issue stocks or bonds to expand their operations or to raise money. Before Initial Public Offerings, firms need a valuation to understand the best price range at which they can offer their stocks to the public. On the buyer’s side, the buying entity wants to arrive at the optimum capital it is willing to pay for its next deal or acquisition, a number that can give investors headway to safer exits.

Here’s where investment banking professionals come into the picture. They arrive at the numbers and advise their clients about the feasibility and potential of the project.

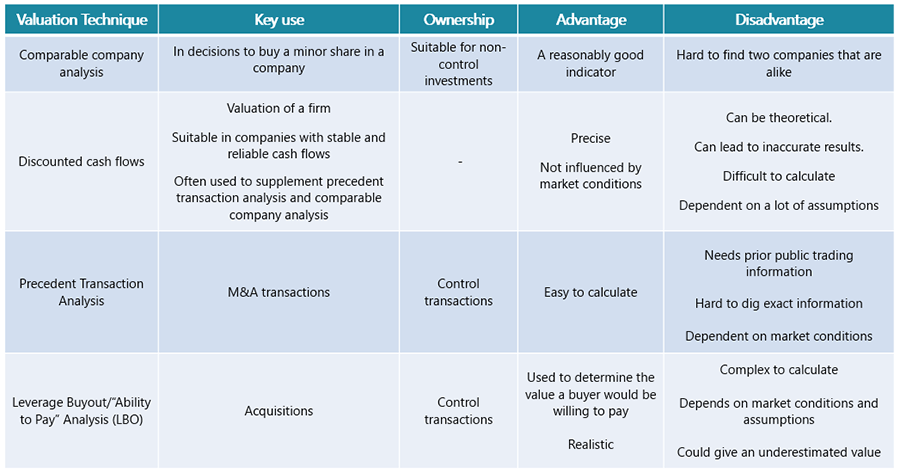

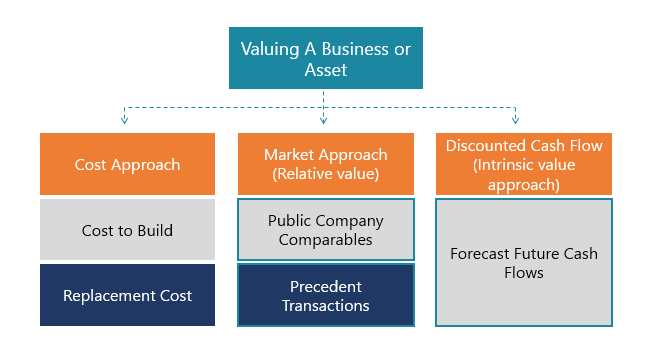

Though valuation can be done in many ways, in this article, we try to cover four most used methods. Corporate Finance Institute says globally investment banking firms are using three broad approaches to valuation: cost approach, market approach and discounted cash flow approach. Most methods are built around these approaches.

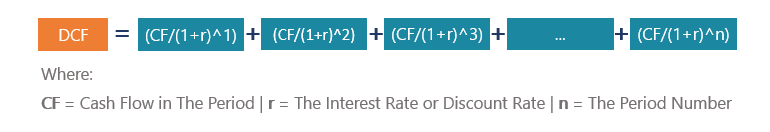

DCF valuation projects the amount of cash a prospect can generate in the future. It is the most precise form of valuation. However, it is also cumbersome to calculate as it involves the calculation of future cash flows and their value after the discount rate.

Calculation

The cash flow here means the “free cash flow” the investor gets during the given period. When calculated for financial modeling “unlevered free cash flow” is considered and when used for bond valuation, interest or principal payments are considered. The period can vary from months, quarters or years.

If investors pay less than the calculated DCF value, they earn more rate of return. If they pay more, they earn less rate of return.

Limitations

DCFs are calculated to a terminal value up to five years because it becomes difficult to make predictions for an extended period after that.

DCF calculations need assumptions and projections and the farther these are from the current conditions, the more difficult they are to calculate.

A slight change in any assumption can heavily influence the predictions.

Best use

DCFs are suitable for companies with reliable and secure cash flows.

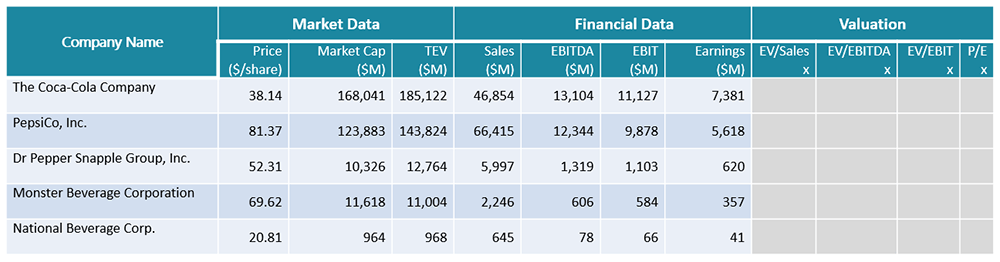

With comparable company analysis, publicly traded securities of similar companies are compared.

Calculation

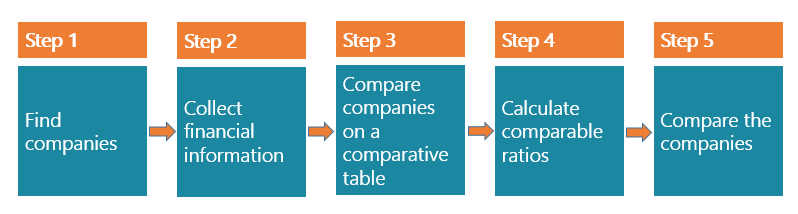

Comparable company analysis is done in five steps.

Step 1: The companies you shortlist must match in size, market, geography, and margins.

Step 2: While collecting financial information, collect metrics like profit and revenue from young companies and EBITDA and EPS from mature firms. You may use the Bloomberg terminal or CapitalIQ for this purpose. Alternatively, information can be collected from quarterly and yearly reports.

Step 3: Create a comparative on excel. Include company name, share prices, market capitalization, EBITDA/EPS/revenue, value and analyst’s valuation.

Step 4: Calculate the ratios Enterprise Value/ Revenue, Enterprise Value/Gross profit, Enterprise Value/ EBITDA, Price to Earnings, Price to Net Asset Value and Price to Book ratios. (For information regarding these ratios, browse the insights section on our website).

Step 5: Use the above information to value the company.

Limitations

Analysts need to choose the comparables wisely and the comparables must reflect risks, trends, growth, etc.

It is hard to find two companies that are alike.

Valuation of illiquid stocks could be difficult.

Best use

Comparable company analysis is best used when one company has almost all control over the shares.

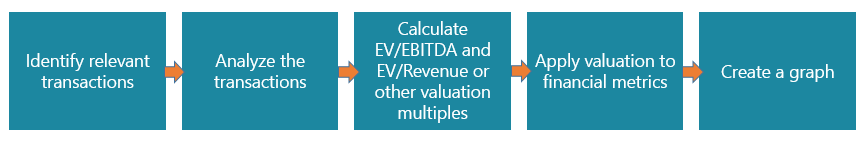

Companies are called precedents. Like the comparable company analysis, precedent transaction analysis begins with the identification of the target company. Analysts dig out specifics from a prior deal (price per share, assumed debt and/or the total number of shares acquired) and compare the industry, company, geography, products, financial metrics, deal size and valuation metrics.

Calculation

Limitations

Precedent transactions analysis becomes difficult in cases wherein required information is either unavailable or inadequate. Often control premiums and synergies are kept away from public knowledge. They can also be transaction-specific.

Valuations may also vary with market fluctuations as the previous valuations could have been done at a more favorable time.

Best use

Precedent transaction analysis is the most suitable valuation method when a buyer acquires a controlling share in another company.

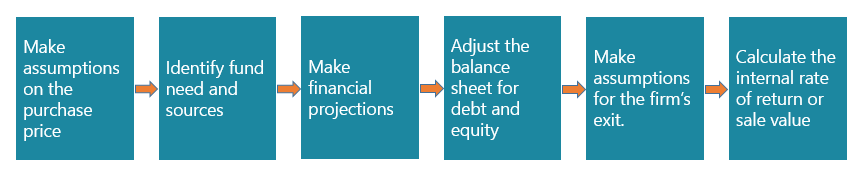

Investors borrow huge sums of money to pay for the acquisition and the assets of both the acquired and the acquiring company act as collaterals for loans.

LBOs consider cash flows from the acquired entity to pay back the debt. Therefore, this is most useful to evaluate companies generating high cash flows.

Calculation

LBO can be calculated in many ways but Investment Bankers usually assume a threshold of return for the sponsor and a suitable debt/ equity ratio. Expected rate of return is between 20%-30%. Usually, LBOs are calculated using high-level and generic assumptions which eases the analyst’s effort.

Limitation

LBOs cannot be used in volatile market conditions.

LBOs are a detailed exercise and may involve refinement of the exercise to tranche-specific calculations.

Best use

LBOs are mostly used by the Private Equity firms who seek to buy companies at an “inexpensive cost” and then later sell it at profit.

Valuation methods vary from region to region and purpose to purpose. While French Underwriters arrive at the valuation methods based on the firm’s characteristics, aggregate returns and volatility in the stock market (Roosenboom, 2007), IPOs in the US use Price to Earnings ratios (PE ratios) and Price-to-Book ratios. Companies in New Zealand are more inclined to Discounted cash flows and PE valuations.

Here's a cheat sheet that can help you pick the right method: