Decarbonization is the process of reducing carbon dioxide and other greenhouse gas emissions, primarily carbon dioxide or CO2, as they are produced in different sectors such as industry, transportation, and energy production. The collective effort forms the backbone of the fight against global warming. This is done to ensure that the planet is stable and turns nothing into chaos. The call for a net zero transition has acquired a sharper tone as the world is faced with the escalating effects of climate change, from sections of the globe constantly being visited by severe weather occurrences to sea level rise, and consequently the loss of biodiversity.

The link between finance and environmental sustainability has given rise to a brand-new investment approach: investing that is based on both financial returns, as well as societal and environmental improvements. Introducing impact investing to decarbonization brings in the same value just as it refers prominently to investments in clean energies, clean technologies, and green projects. The investment banks perform a key function of redirecting the capital resources towards such portfolio companies so that the impact of the transition to the low carbon economies is accelerated while investors not only reap value from such activities but the society.

The process of having more understanding of investment bank’s role as a key driver of decarbonization indicates that sustainable finance is now a trend but also ultimately a strategic choice for the global economy. They can develop solutions that are useful for their clients through their financial expertise, market insights as well as collaborative networks and help create a more enchanting future and resilient community.

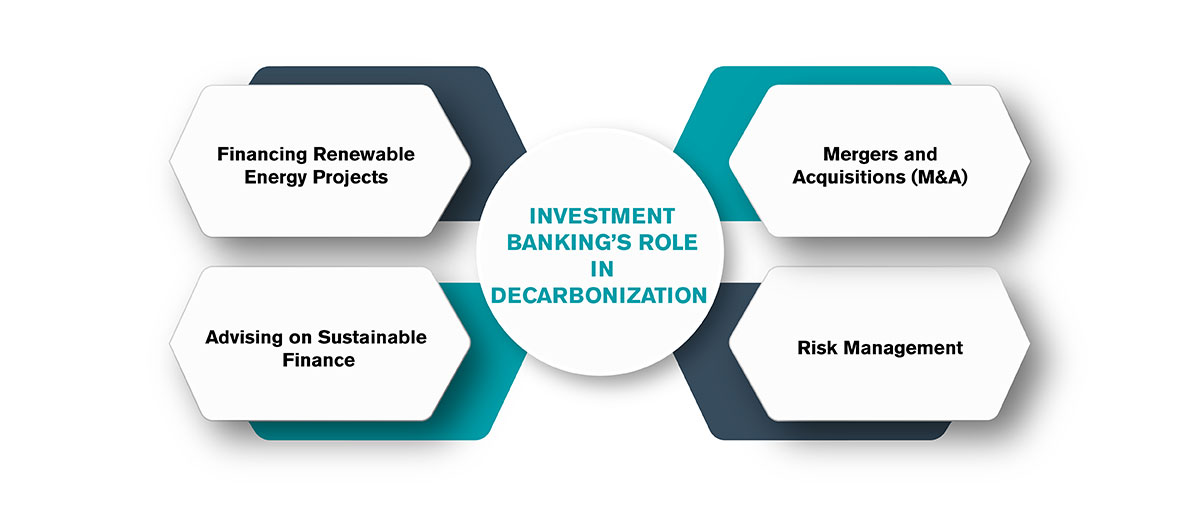

Investment banks provide crucial avenues for the implementation of divergent inter alia strategies and initiatives that aim at decarbonization.

Financing Renewable Energy Projects: Banks of this type of investment are pushing pre-finance green power projects – photovoltaic, wind, and hydroelectric. Investment banks’ support in providing capital and financial knowledge means that renewable energy sources can be developed and initiated. This ultimately results in lesser usage of fossil fuels and transmission towards a low-carbon economy. This is doing many things at once; not only slashing down greenhouse gas emissions but creating new ones for clean growth and advancement.

Advising on Sustainable Finance: Investment banks not only collaborate with companies by providing them with financial strategies on sustainability, but they also provide further services. These options earmark capital in the green bonds and sustainability-linked loans and create projects, rolling it into those that are environmentally sustainable. Although sustainability considerations, investment banks ensure them in this way contribute toward socially and environmentally responsible investment decisions and as well encourage the business alignment with environmental objectives.

Mergers and Acquisitions (M&A): Investment banks transform carbon-intensive firms into sustainable ones through M&A deals that result in decarbonization. These firms can help identify promising targets for acquisition such as those with advanced green technology or sustainable business models which in turn upgrade their environmental commitment. Furthermore, investment banks are also entrusted with the provision of disinvestment planning techniques enabling companies to move from carbon-intensive to less polluting operations.

Risk Management: Investment banks are the key to the management of climate risks because of their special role in climate action. They elevate the extreme risks of handling investments in a climate-changed environment, and they advise clients on the possible strategies to avoid risks. By merging environmental, social, and governance (ESG) with risk assessment processes, investment banks aid investors in arriving at informative options that factor into long-term sustainability for the economy.

In addition to the straightforward financial dealings, investment banking’s involvement in the transition away from carbon reliance is multifunctional. It involves considerable financing of environmentally friendly methods, the introduction of new technologies, as well as business partnerships that are aimed at making the world less carbon-dependent. As experts and due to their direct power, investment banks are the key players who can engage in the process of transition to a more sustainable society.

Investment banking’s role in driving decarbonization is not without its challenges and opportunities:

Regulatory Compliance: As long as the investment banking scenario moves towards mature regulatory requirements that support sustainable finance, it becomes obvious that investment banks have to make sure that they're up-to-date on the changing compliance requirements. Being able to navigate challenges while seizing the opportunities of developing green finance proficiency and being ahead of the curve is not an easy process.

Technological Innovation: A precise example of a technical update that is comprised of blockchain and artificial intelligence provides both challenges and benefits for investment banks. Sustainable finance transactions, and in turn risk practices, can be advanced to a new level of efficiency, nevertheless, the process of proper implementation is interconnected to the availability of the appropriate investment in infrastructure and expertise.

Market Demand: Investment banks may capitalize on the rapidly growing trend in demand for sustainable options when clients and investors are quite particular about their products and services that are environmentally friendly. The banks can exploit the trend of green-oriented clients by offering new financial services that meet the sustainability targets thereby attracting the clients of this fast-growing segment, and thus boosting their market standing.

Risk Management: In addition to traditional risks, climate risk is a preoccupation for the investment banks which led them to the evaluation of climate change in their investments and in consequence to work out measures to minimise those risks. Notwithstanding this, protesting risk conformity can also create a chance for banks to stand out and laser-focused investors with socially responsible investments.

Collaboration and Partnerships: Environmental facilitation through working with governments, multilateral institutions, stakeholders, and other entities is crucial for investment banks in developing creative solutions for sustainable development investment. These networks are very difficult to establish and subsist. However, these partnerships provide the banks with new channels to potential customers and various funding sources.

Decarbonization's future and its link with investment banking are bound to face certain changes, driven by the joint impact of regulatory, technological, and market phenomena.

Regulatory Landscape: With world governments unanimous on prospective decarbonization targets, investment banks will have to find a manageable way to deal with the escalating regulatory restrictions geared towards the prosperity of sustainable finance and lowering carbon emissions globally. This would result in the rise of new and strictly consolidated compliance management systems for banks, and their business models will need to re-align with the ever-changing regulatory requirements.

Technological Innovations: In the low-carbon economy of the future, renewable energy will be deployed with the help of technological advances. Technologies that will allow more efficient use of energy and the transition process from carbon-based to renewable energy will also contribute to a shift towards a decentralized and efficient energy system. Investment banks are envisioned to take up a hauling role of providing financial operations to back innovations and the adoption of leading technologies which incumbents are capable of initiating.

ESG Integration: ESG frameworks which deal with environmental, social, and governance will be considered a major factor driving investment decisions and management processes. Investment banks have to incorporate ESG components into their risk evaluation and investment scheme, reflecting deeper ESG impact upon investment.

Market Demand: The emergence of a sustainable economy is supposed to be the major moto force behind the rapid proliferation of the green finance market. Investment banks will be required to be creative and develop new financial instruments which can assist the investors in making their investments match their planning regarding environmental sustainability.

Investment banks have demonstrated their commitment to impact investing and driving decarbonization through various initiatives and best practices:

Goldman Sachs: Last year saw the launch of the Sustainable Finance Group which is a dedicated team at Goldman Sachs that provides financial tools for projects that are sustainable. This group offers its customers the chance to consider options in sustainable investment activities that will lead to tax amounting to $750 billion by 2030 on the environment. For example, an interesting venture with the same foundation is a large solar power plant that was built in a remote place to supply electricity to the local population thus, reducing its carbon footprint.

JPMorgan Chase: JPMorgan Chase, one of the key players in sustainable finance, has a Sustainable Finance unit that provides advisory services to the clients on incorporation of environmental and social parameters in their ways of business. The bank has now taken on the undertaking of doubling the size of its sustainable credit from $1.25 trillion to $2.5 trillion by the end of 2030, contributing to efforts that are redirecting investments into sustainable transport and energy-efficient building renovations. JPMorgan Chase had a game-changing statement that opened its doors to the design of, innovative financial solutions dedicated to fighting climate change and achieving sustainable development.

UBS: UBS have keenly been aligning the ESG factors in their investment appraisals to strike a balance of the environmental, social and governance factors in their decision-making process. The bank gives diverse solutions for sustainable investment, involving green bonds and ESG-oriented funds, to suit the taste of the investors as their needs change. UBS has also been heavily involved in financing projects both globally and locally which are in tune with sustainable development. Some of these projects are financing renewable energy infrastructures such as solar and wind power as well as promoting sustainable agriculture practices. By prioritising activities that synchronise with the sustainable finance concept, the UBS group will create an impact that the invested funds will make and contribute to carbon mitigation efforts.

The case studies illustrate that investment banks are a vital part of the process that brings sustainable financing and high-impact investing on the move, which leads to the transition to a low-carbon economy. Combining creative partnerships, breakthrough funding schemes and an indomitable environmental responsibility as its objectives, investment banks will still prevail and continue being agents of change in the quest to fight climate change and spur development.