Investment banking is one of the brightest careers. It requires a lot of dedication and high statistical knowledge to become a successful investment banker. It is a fair play on intellect. It is a key to the growth of any country's economy. An investment banker helps businesses achieve great heights and expand new horizons of opportunities.

Often, people confuse investment banking with mere transactions, but this isn't true. Investment banking enhances capital, increases the power of enterprises and enhances progress. It reshapes the industry and plays a major role in forming the global economy, which impacts each of us either directly or indirectly.

This article explores the intricacies of investment banking salaries, shedding light on the financial rewards that accompany this challenging profession.

An investment banker plays a pivotal role in improving a company's financial position by implementing strategies such as equity sales and debt management. They provide essential support by conducting thorough research and effectively managing risks, contributing to the company's progress and success.

The main roles and responsibilities of an investment banker include:

Equity research and asset handling: An investment banker conducts thorough research to guide clients in making strategic investments in properties and deals. They manage client investments, including stocks and property, aiming to maximize their clients’ financial gains.

Structuring deals: An investment banker meticulously analyzes market trends, financial data, and client needs to craft tailored deals structured in a way that maximizes value and minimizes risks for their clients.

Dealing with mergers and acquisitions: An investment banker handles all the deals, like major transactions, mergers, and corporate finance, to raise the funds of the clients.

Team coordination: Managing groups of experts, including lawyers, accounting professionals, and public relations specialists, to effectively carry out transactions

To pursue an investment banking career, it is important to have a bachelor's degree in finance, accounting, or any related field. Certification and degrees like an MBA in Finance, or a CA are the best options to gain more command in the sector.

Certifications can significantly impact investment banker salaries by enhancing skills such as risk management, research, and financial knowledge. These certifications serve as valuable add-ons, offering specialized training crucial for success in the field.

Additionally, it is crucial for aspiring investment bankers to gain industry exposure through internships. These experiences significantly increase the chances of securing positions with reputable firms and improve negotiation skills for salary discussions. Internships offer invaluable practical insights and hands-on experience in the field.

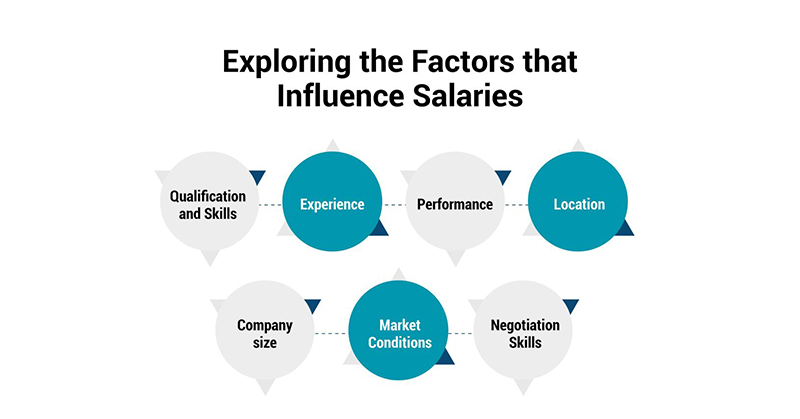

Just like an investment banking career, the salary of an investment banker is also fascinating. The investment banker's average salary is approximately USD131,021. But this isn’t fixed. Investment banker salaries depend on several factors. The more you are exposed to industry, the more compensation you will receive for your work.

The salary of an investment banker is influenced by the demanding nature of the work, which requires meeting tight deadlines and consistently delivering high performance. This high-pressure environment justifies the higher compensation compared to other professions.

The nature of work and long working hours in investment banking contribute to higher compensation. Investment bankers typically work at least 70 hours a week which requires them to consistently perform at a high level.

The investment banking industry highly dependent on the performance of individuals or organizations. If an organization or an individual does exceptionally well in a year, there is a certain set of fixed bonuses they get at year-end.

In many cases, the bonus received is 50% of the base salary. A few banks can also offer up to 100% of the employee's base salary as a bonus. Most of the hike is observed in the banks located in New York and other big cities. On the other hand, bonuses can be lower in cities like London.

The scope of investment banking is spread across the globe. It helps an investment banker to unlock various opportunities worldwide and earn more. Investment banking is an essential bridge between business and the financial markets, contributing to the global financial environment. It is helpful to earn more, especially in places like New York, Singapore, etc.

Base salary refers to the fixed amount of money an investment banker receives without any further compensation or bonuses added. The range of the base salary for all positions is fixed. People working in an analyst position have a lower base salary when compared to associates. Furthermore, the president or vice president receives the highest base income.

For example, an investment banker at the analyst level has a base salary ranging from approximately USD 100-USD 125K, while that of a senior vice president typically rises to approximately USD 300-USD 350K. The base salary is also affected by the bank a person is working. JPMorgan, Goldman Sachs, Bank of America, and Morgan Stanley are among the banks known for offering the highest base salaries to their employees.

The investment banking career's compensation is largely performance-based. While there is a general salary range for investment bankers, the final compensation varies based on individual and organizational deal-making success. Those who consistently close significant deals and generate profits for the bank can earn substantial rewards.

For example, an associate working at a top banking firm will earn more than an associate at a lower bank. Similarly, an associate in the same bank will receive a higher bonus than an analyst in the same bank. The various types of bonuses that an investment banker receives are year-end bonuses, signing bonuses, performance bonuses, etc.

Total compensation is the final amount an investment banker receives after combining the base salary and the bonuses. Compensation covers other elements like stock options and annual profit. They are also entitled to receive the signing bonus that an analyst gets when he accepts a full-time offer.

All these things contribute towards the final compensation of the investment banker. However, it is important to know that the compensation range is different for banks. The highest compensation is offered by banks like Goldman, JP Morgan, and Morgan Stanley.

Having the desired qualifications and skill set plays a crucial role in earning more. Companies look for people who have a bachelor's in finance and accounting or a similar field. Furthermore, an MBA in finance and investment banking certification serves as an advantage. Earning licenses can also increase the average salary of an investment banker.

The more experience an investment banker gains, the greater the hike in investment banker salaries. Once an investment banker moves from the position of analyst to further positions, salary hikes are seen.

The average investment banker salary at the analyst level is USD 140- USD190K, while a person working as a vice president can get up to USD 450-USD 650K.

The performance of the investment banking industry affects career success. An investment banker with a proven track record of bringing financial benefits to clients will receive more perks.

For this, a person should carry out a background check and stay updated with the latest trends. It is important to make the best decisions, thus getting better results.

Location is another factor that determines an investment banker's average salary. Global financial cities like Hong Kong, New York, and Singapore offer higher average salaries. This is because the cost of living is quite high in these cities. Contrary to this, cities with a lower cost of living pay less to investment bankers.

The size of the company is effective in determining investment banker salaries. Banks like JP Morgan and Goldman Sachs have strong networks and more work. Hence, they offer higher salaries to investment bankers when compared to the smaller banks. Working at elite boutique banks also opens the door to more perks and incentives.

An investment banker's salary is greatly affected by market conditions. Any fluctuations in the current trend can affect the salary. Factors like inflation, interest rates, and regulatory changes can affect the overall salary. If the country or the company is already dealing with financial issues, the compensation will be less than expected.

Negotiation skills are crucial for investment bankers to maximize their earning potential. By highlighting their qualifications and achievements, bankers can successfully negotiate higher compensation. Although challenging, effective negotiation is essential for long-term financial success in this field.

An investment banker plays a crucial role in the finance industry, facilitating capital raising, mergers and acquisitions investment banking, and other complex financial transactions. The work done by them brings financial benefits to their organization. An investment banking career isn't a simple one. Instead, it requires a lot of research and labor. It requires hours of dedication and a grasp of all the financial aspects. Thus, an investment banker's average salary is also higher than others.

Investment banker salaries are influenced by various factors beyond just the nature of the work and the high-pressure environment. These include the banker's expertise, the complexity of deals they handle, and the overall performance of the financial markets. It is also important to have good communication skills to build relationships with clients.

Therefore, to become an investment banker, it is necessary to be well-versed in all the important factors included in the journey of becoming an investment banker. These include how to get into investment banking, career paths, educational qualifications, etc. Investment banking is a promising career with various perks, especially in the form of a good salary. With the required skills and qualifications, it is easy to build a successful and rewarding investment banking career path.