Big data is at the center of re-engineering works carried out by investment banks under the influence of emerging technologies. It is being adopted to value-based pricing models; detect and prevent frauds; reduce customer churn rates; and thus, improve customer satisfaction.

The investment banking sector faces pressures on cost as well as from economic swings. It is crucial to increase business efficiency to attract and satisfy customers, which can lead to profit. A few of the shortcomings at investment banks include:

Inability to manage and analyze huge volumes of unstructured customer data

Lack of a robust strategy to drive sales through customer satisfaction

Categorize and monitor customer behavior to predict risks

Offerings that are not personalized and do not meet the needs of varied customer segments

No development of long-term relationships with customers

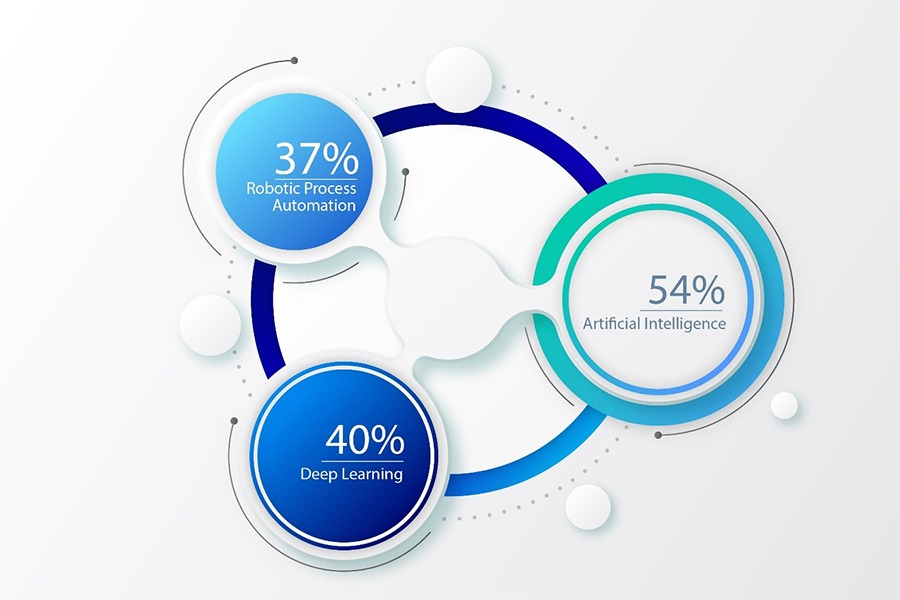

To combat this uphill battle, investment banking industries are leveraging big data analytics to get profound insights into the customer data, improve customer satisfaction, and reduce churn rates. According to PwC’s survey results, almost 80 percent of banking institutions are using big data tools. Here are the purposes for which institutions use big data analytics:

And, 90 percent of these businesses have seen an improvement in productivity as a direct result

Goldman Sachs took the lead by investing USD 15 million in big data analytics. At Goldman Sachs, big data automation is helping the front-office teams to answer complex questions on global market scenarios. Likewise, Citigroup uses big data technology for customer service, fraud detection, and web analytics.

According to a report from Citi, financial institutions use big data for GDP forecasts and interest rate calculations. The ability to capture and process data quickly has given us new ways to capture investment themes such as momentum, value, and profitability.

Take a look at the principal drivers to adopt big data technologies.

Continuous data growth: Technology is advancing at a rapid rate, and consumers are using different types of devices for transactions. The use of big data helps to combine digital and physical channel interactions and provides the financial institution to collect, integrate, and analyze all data.

Changing regulations: There are disparate data sets for individual business activities having point-in-time information. This information may need reassembling to understand the compliance or risk purposes. Further, the banks are expected to possess a ‘horizontal view’ of risk. The use of big data tools helps them to analyze data in real time and manage ever-increasing data efficiently.

Fraud detection and security: Big data extends the scope of current analytical infrastructure. It helps to conduct analyses on the whole spectrum of data available, and not just on a limited sample.

Customer insight and marketing analytics: Big data technologies enable the banks to collect and integrate transactional and unstructured data, and highlight customer-centricity in dealing efforts.

In brief, big data technology adoption enables the industry to develop and test trading strategies in real time, develop new strategies by adopting data into processes, find unique market opportunities, calibrate derivative pricing models, and make informed investment decisions.

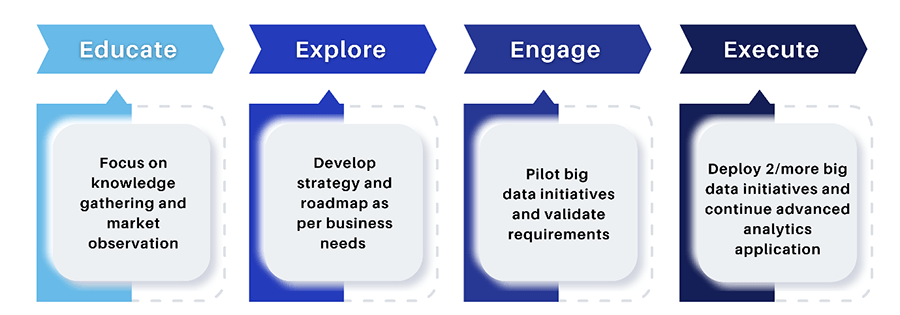

Moving forward, let’s understand how to adopt big data. IBM outlines four phases of big data adoption:

In brief, to maximize the benefits of big data analytics, a company should be committed to its efforts. They should develop an enterprise-wide big data blueprint, start with existing data, understand business priorities, build analytical capabilities, and continue advancing analytics applications. This would lead to a continued and measurable outcome.

Depending on your industry vertical and the intention, user can choose single or multiple technologies. Here are the four key aspects of big data technology.

Infrastructure: The infrastructure should support scalability and flexibility to handle petabytes of data. For this, you can opt for cloud through public providers such as Amazon Web Services or Rackspace.

Data storage: Hadoop is best recommended for big data storage. A few of the big data storage players include MongoDB, Hadoop, and Netezza.

Data processing and management: The data processors and managers such as Hadoop, Greenplum, or Cloudera can be used to process a growing mass of data in parallel.

Data analytics: Some of the key data analytics providers for data visualization and predictive analytics include Splunk, Pervasive, MapR, and Progress data Direct.

JP Morgan, one of the biggest banks in the United States has a customer base of over 3 billion.

JP Morgan Chase generates a vast amount of credit card information and other transactional data for its US-based customers.

The volume of data generated is so huge that they have implemented Hadoop to handle data. They are now able to get insights into customer trends and share the reports with clients.

They use a mix of Hadoop, NoSQL, and predictive analytics of big data in their operations area.

The use of big data technology has enabled the bank to segment their customers, even into single individuals, and generate reports in seconds.

Deutsche Bank uses big data for various benefits:

Big data is used on trading and risk data [i.e. the data collected for over 10 years]

Automated personalized recommendation algorithms are used to improve customer intimacy

Detect fraudulent transactions [such as money laundering and use of stolen credit cards]

Manages unstructured data through Hadoop

Deutsche Bank has reduced its operational costs and has multiple production Hadoop platforms.

Big data technologies will continue to shape the future of the investment banking industry, by enabling them to provide timely, cost-effective, and reliable services to clients. Though there is a significant upside in its adoption, some more time is required for it to become a part of the standard business dynamics.

A more pragmatic approach is still essential. Investment businesses must prioritize investments, ask the right questions, focus on business problems, and avoid pitfalls to become a differentiator in the market.