If you want a simple job, with few challenges and no pressure, do not keep investment banking on your list. Simplicity and predictability have never been the hallmarks of this domain, but what it does offer – and in spades – are chances to crack complicated, high-pressure deals along with identifying and pitching to clients.

Investment bankers take on a variety of often tedious tasks, such as business valuation, deal negotiation, financial modeling, marketing, relationship management, risk mitigation, sales pitches, and transaction documentation. These are part of their responsibilities in exploring investors, sharing market insights with clients, and creating innovative finance models.

As with other fields, technology is causing disruptions in investment banking as well. Across industries, more advanced and strategic solutions are in demand, with traditional approaches not holding forth anymore. With challenges growing fast, the investment banking industry must transform to be able to meet its objectives.

The conventional career path had a young graduate right out of college, joining an investment bank as an associate, and moving up the levels to ultimately reach the position of a managing director. During this time, (s)he would work 90-hour weeks of presentations and spreadsheets, but these would be counted as mile markers en route to a successful career with admiration and respect and, of course, fat paychecks.

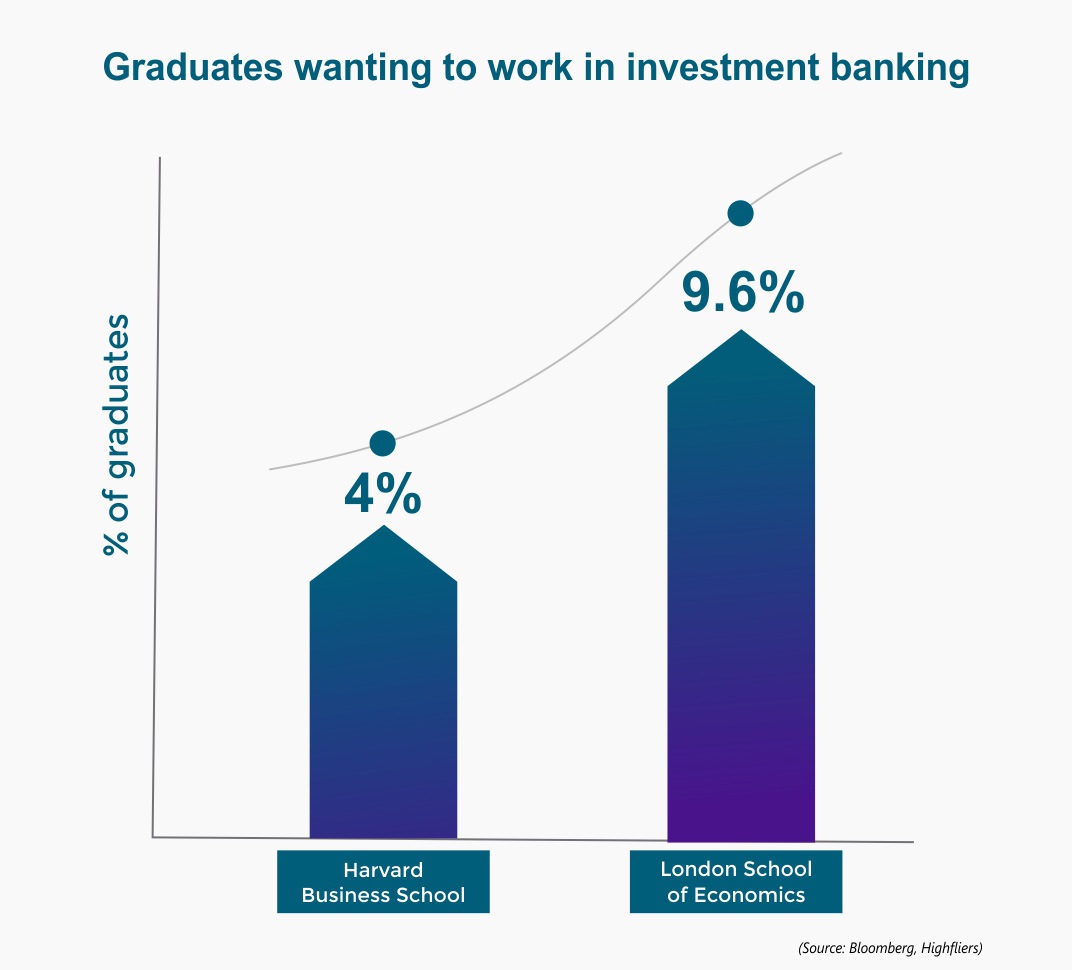

Things have changed with time, with this career line not quite finding the favor of old. Tough business cycles have cut the chances of competitive wages for dealmakers, but the taxing lifestyle has also played its part. The long hours, tight deadlines, and constant work on pitches are not quite as rewarding as earlier.

Banks had to deal with training young bankers who would exit soon after reaching the necessary levels of experience and expertise. In Asia, for instance, the exodus is growing faster than in any other part of the world, as reported by Bloomberg. Even 30 percent pay hikes have not worked their magic, nor have the promises of promotions – and this has affected the growth plans of banks.

The consequence for an investment bank is heavy. Some banks take a hit of up to USD 1 billion annually to fill spots vacated by voluntary exits. Courtesy technology, private equity, and other sectors, the brain drain from investment banking is real, and it is costly.

Candidates are increasingly choosing disruptive startups where they get more flexibility and responsibilities, and their work is seen to be impactful. From attractive job profiles to better pay packages and hefty ESOPs, much is luring away the mid- and senior-level talent pool.

The brightest banking minds are being pulled away to social media and technology firms, along with old-favorite hedge funds and PE firms. The old favorites often pay better now, and along with this, candidates are offered global experiences, high responsibility, quick growth, and excellent work-life balance.

The capital markets and investment banking (CMIB) industry is a dynamic place with much innovation, regularly requiring new compliance solutions. For this,

Front offices will need broader skills in data, technology, and regulation.

The post-trade side of the value chain will be in focus, with highly-skilled people needed in compliance, legal, operations, and risk.

Employees knowledgeable about evolving and new regulations will be required to deal with rising costs of litigation.

Regulations have played their role in tempering the momentum of ballooning pay packages in investment banking. Bonuses are now capped to particular ratios, which in turn have led banks in the respective countries to become less competitive. Then there have been scandals of ethics and keener public scrutiny of bonuses, because of which learning and development has given more weight to compliance matters. This has been at the cost of sufficient effort and resources toward career development for investment banks.

The situation has compelled investment banks to look inward – “soul-searching”, as it were. The hiring pool has traditionally included only top-ranked universities and finance degrees, and a more diverse set of candidates would further broaden its appeal. Banks have been putting in more efforts to upskill new recruits, offering much more structured training opportunities for ambitious, young students. Combining appropriate training and mentoring with making the junior bankers feel part of a team that values their work will ultimately boost the value the bank itself earns.

To retain their top employees over the long term and avoid the costs of voluntary turnover, investment banks must stress on the following:

Be transparent about promotions and bonuses

Actively promote open internal communication

Provide access to capable mentors

Strip out tedious, low-value manual processes with technology

Actively update skill development programs as part of company policy

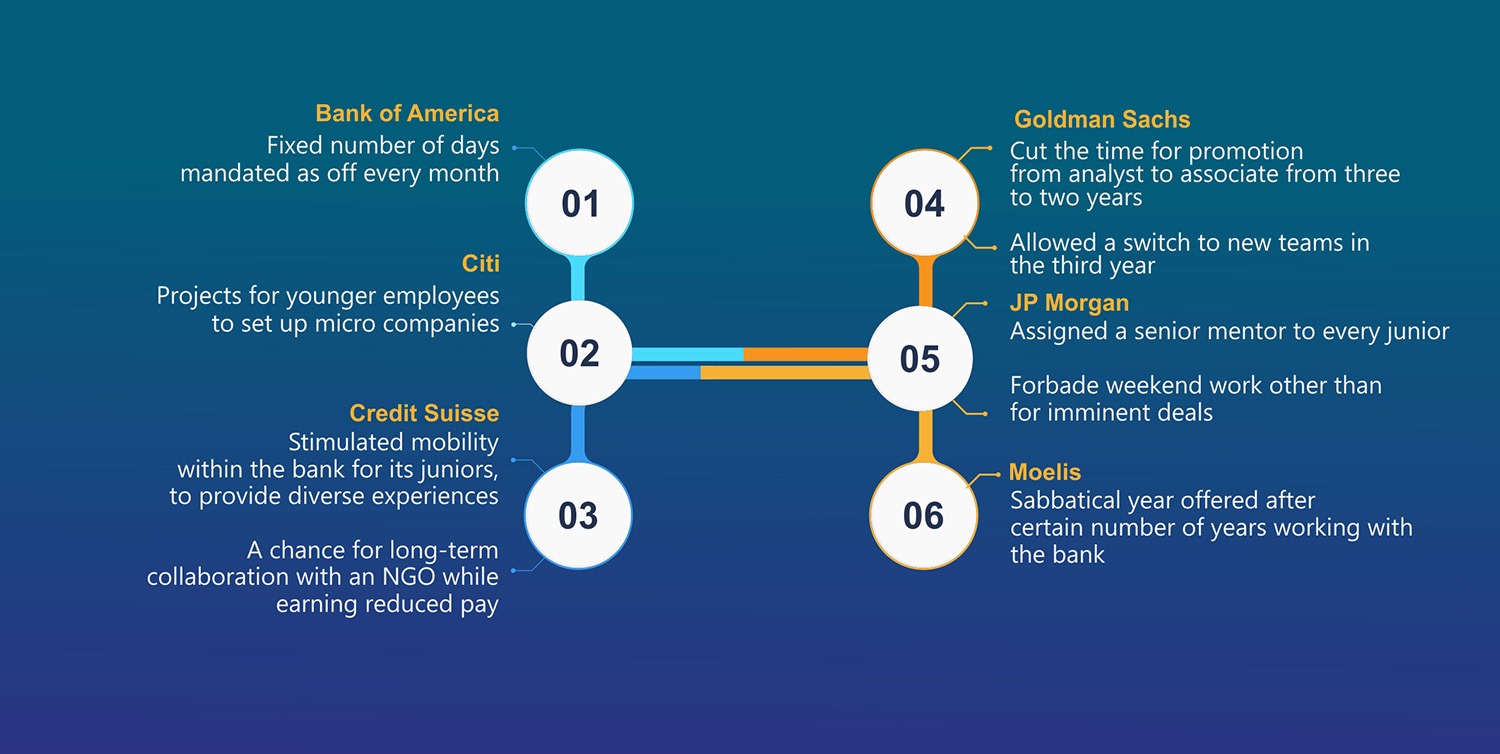

Here is how some top investment banks have battled for talent:

Investment banks know what kind of people they need to be ready for the future, and they must continue to try to attract such candidates. Broad skills, entrepreneurship and innovation, and a strong cultural sense remain imperative, and banks must ensure they climb up the ranks of great places to work! A radically new value proposition is of the order, and immediate focus must be directed toward the following:

People development:

Cover basic disciplines of people management, with both soft and hard metrics.

Personalize training and development programs.

Recognize the absence of a mandatory connect between high performance and people management capabilities, and staff people accordingly.

Strategic workforce planning:

Look for alternative channels to hire candidates.

Rigorously manage career paths, while being transparent about designations and promotions.

Implement active performance management and outplacement.

The battle for investment banking talent is real, and banks must act if they wish to have skilled people on board to take them toward long-term, future success. Ingraining better talent practices into their DNA is the only way to attract and retain bright professionals, so that investment banking is freed from the image of serving as a mere launch pad for other careers.