AI is transforming finance in a way that is compelling professionals to operate more quickly, handle data more accurately, and make decisions using smart systems. Market cycles always change, yet the current shift calls for new strengths built around sharper judgment, stronger data skills, and a more deliberate approach to strategic thinking. Automation is already affecting jobs related to complex transactions, such as investment banking, making it unclear how professions will adapt. Finance departments have shifted their attention to individuals who can operate effectively with sophisticated equipment and remain rooted in the analytical discipline.

The redefinition of talent appreciation becomes necessary as many of the operational functions are transformed by the automation of investment banking. Routine modeling, data cleaning, and initial valuation processes that characterized early careers are now done more effectively with automated workflows. Human roles move toward deeper analysis, clear judgment, and strategic contribution. Professionals who strengthen their ability to assess information, communicate effectively, and guide oversight will play a more influential part in shaping future success in banking.

AI will transform most of the jobs that previously had to be done manually; the routine work of analysts, associates, and operations personnel will change in meaningful ways. Previous manual data collection, preliminary valuations, pitch books, and standard reports are becoming automated. The human roles will be changed to supervision, interpretation, interaction with clients, and strategic thinking.

According to a 2025 survey by the Gartner Finance Practice, 59 percent of finance leaders said that they have been actively using AI in their finance functions. This change is indicative of a wider acceptance of automated assistance in modeling, review processes, and compliance reviews. It also demonstrates the extent to which teams are turning to AI to balance the workloads, shorten turnaround durations, and shift focus to decisions that require market or customer priorities.

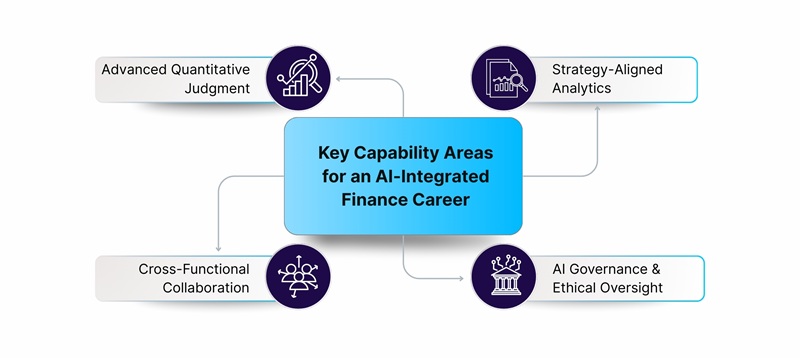

The skills in analytics will no longer be a source of employment security. The 2025 research of the World Economic Forum released recently shows that 32-39 percent of tasks in capital markets, insurance, and other financial services are now possible to be carried out by AI-enabled tools. That is what makes technical fluency significant, though not enough. The professionals who will shine through are those who come to the table with business knowledge, risk management, ethical decision-making, and real-life experience.

The strategic application of AI to investment banking changes the decision cycles from being periodic and reactive to continuous and insight-driven. Deal teams are able to query much larger data sets, model scenarios, and bring to light signals that would not have been visible in manual models. Final decisions remain in the hands of human judgment, but AI assists in organizing the information in such a way that trade-offs, risk exposures, and implications of a client are more evident and easier to evaluate. The Investment Banking Industry Survey Report 2025 by SG Analytics states that 66 percent of companies are hastening investment in AI and machine learning in order to enhance the quality of decisions and operational efficiency.

Investment banking automation is most beneficial to finance leaders when it is combined with judgment-intensive activities, such as:

AI-based financial leadership begins with purpose and strong boundaries. The executives determine how the use of AI in investment banking helps achieve client outcomes, risk appetite, and regulation, and translate that into rules that apply to the work of teams. The change of talent strategy focuses on hybrid functions, which are a combination of financial judgment, data skills, and model oversight, and culture compensates for experimentation supported by disciplined testing and documentation.

The way ahead lies in the understanding that human insight is a core part, despite the increased sophistication of automation. The ability to adapt to new tools, challenge assumptions, and sharpen judgment produces stronger results by professionals who are working in an environment shaped by investment banking automation. The future of work is a combination of technical fluency and strategic thinking, particularly as companies incorporate AI in the field of investment banking and determine what AI will replace investment banking with in long-term investment banking positions. Remaining interested, nimble, and ready keeps careers on the move.